Understanding the Value of 0.29 ETH

Have you ever wondered what 0.29 ETH is worth in today’s market? As the cryptocurrency world continues to evolve, understanding the value of different cryptocurrencies, like Ethereum (ETH), is crucial. Let’s dive into the details of 0.29 ETH and explore its significance.

What is Ethereum (ETH)?

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of downtime, fraud, or third-party interference. The native cryptocurrency of Ethereum is called Ether (ETH), which is used to pay for transaction fees and services on the network.

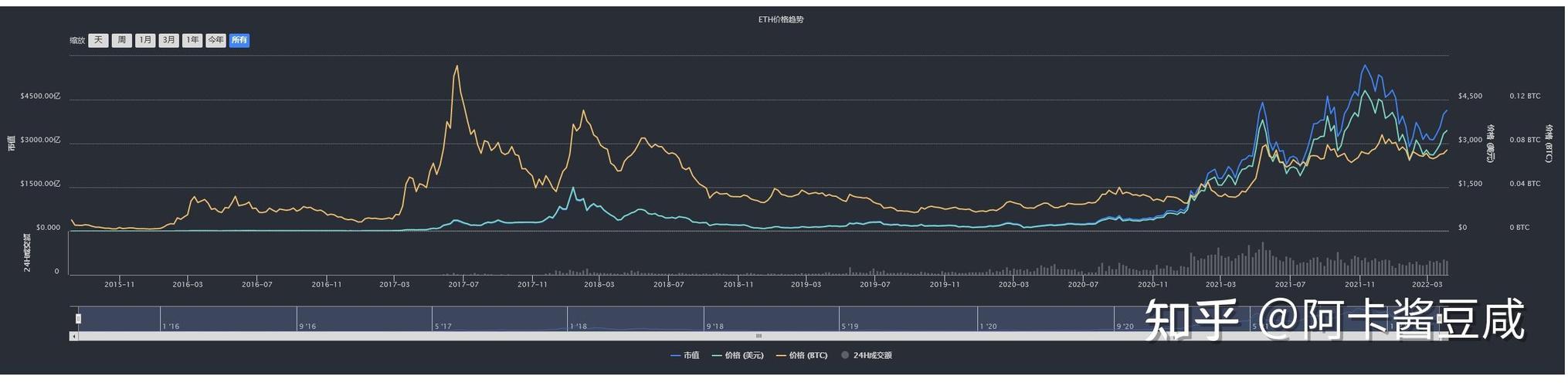

Historical Price of ETH

The price of ETH has seen significant fluctuations over the years. As of the time of writing, the historical price of ETH can be summarized in the following table:

| Year | Starting Price (USD) | Ending Price (USD) | Change (%) |

|---|---|---|---|

| 2015 | 0.31 | 2.8 | 8,828.52 |

| 2016 | 2.8 | 0.6 | -78.57 |

| 2017 | 8 | 730 | 8,875.00 |

| 2018 | 1400 | 85 | -94.21 |

| 2019 | 130 | 130 | 0.00 |

| 2020 | 130 | 730 | 453.85 |

| 2021 | 730 | 6,000 | 828.57 |

Factors Influencing ETH Price

Several factors influence the price of ETH. Here are some of the key factors:

-

Market Supply and Demand: The supply and demand of ETH in the market play a significant role in determining its price. When demand is high, the price tends to rise, and vice versa.

-

Market Sentiment: The overall sentiment of the market towards ETH can also impact its price. Positive news and developments can lead to increased demand and higher prices, while negative news can have the opposite effect.

-

Regulatory Changes: Changes in regulations regarding cryptocurrencies can significantly impact the price of ETH. For example, stricter regulations can lead to a decrease in demand and lower prices.

-

Technological Developments: Technological advancements in the Ethereum network, such as the Ethereum 2.0 upgrade, can also influence the price of ETH.

How to Predict ETH Price

Predicting the price of ETH is challenging, but there are several methods that can be used:

-

Technical Analysis: This involves analyzing historical price data and using various tools and indicators to predict future price movements.

-

Fundamental Analysis: This involves analyzing the underlying factors that influence the price of ETH, such as market supply and demand, regulatory changes, and technological developments.

-

Sentiment Analysis: This involves analyzing the overall sentiment of the market towards ETH to predict future price movements.

Real-Time ETH Price Tracking

Keeping track of the real-time price of ETH is essential for making informed decisions. Here are some popular platforms where you can find the latest ETH price:

-

CoinMarketCap: This platform provides real-time price data for ETH and other cryptocurrencies.