Eth Coin Price is Hitting History High: A Detailed Multi-Dimensional Overview

As the digital currency landscape continues to evolve, Ethereum (ETH) has emerged as a leading player, with its price soaring to unprecedented heights. In this article, we delve into the various factors contributing to this remarkable surge, offering you a comprehensive understanding of what’s driving the ETH coin price to new all-time highs.

Market Dynamics

The cryptocurrency market has been experiencing a significant bull run, with many digital assets witnessing substantial price increases. Ethereum, being one of the most popular and widely used blockchain platforms, has not been left behind. Its price has been on a steady upward trajectory, propelled by a combination of factors.

Smart Contracts and Decentralized Applications

Ethereum’s primary innovation lies in its ability to support smart contracts and decentralized applications (DApps). These features have made it a preferred platform for developers looking to create decentralized solutions. As the number of DApps and smart contracts on the Ethereum network continues to grow, the demand for ETH has surged, pushing its price higher.

Network Expansion and Scalability

One of the key challenges faced by Ethereum has been scalability. However, the Ethereum community has been actively working on solutions to address this issue. The upcoming Ethereum 2.0 upgrade, which aims to transition the network to a proof-of-stake consensus mechanism, is expected to significantly improve scalability and reduce transaction fees. This has generated a lot of excitement among investors, leading to increased demand for ETH.

Institutional Interest

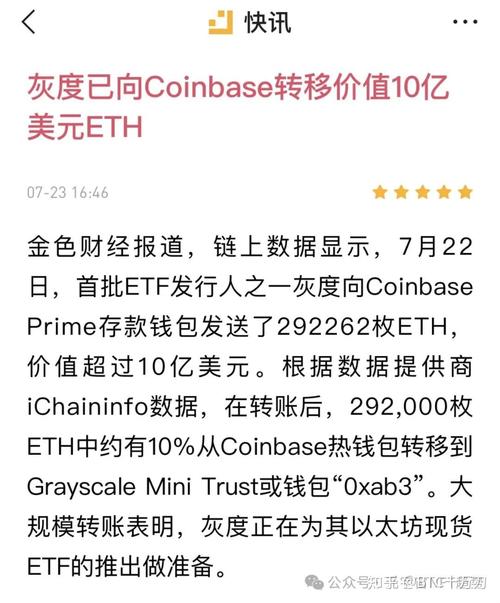

The growing interest in cryptocurrencies from institutional investors has also played a crucial role in driving up the ETH price. Many institutional investors have started allocating a portion of their portfolios to digital assets, with Ethereum being one of the most popular choices. This influx of institutional capital has further bolstered the demand for ETH, pushing its price higher.

Regulatory Environment

The regulatory environment has also had a significant impact on the ETH price. While some countries have implemented strict regulations on cryptocurrencies, others have taken a more lenient approach. The European Union, for instance, has been working on a regulatory framework for digital assets, which could potentially open up new opportunities for Ethereum and its DApps.

Competition and Alternatives

Despite Ethereum’s dominance in the market, it faces stiff competition from other blockchain platforms, such as Binance Smart Chain (BSC) and Cardano (ADA). These platforms offer similar functionalities and are continuously improving their features to attract developers and users. However, Ethereum’s strong community and established ecosystem have given it a competitive edge, making it the preferred choice for many.

Market Sentiment

Market sentiment has also played a crucial role in driving the ETH price higher. The growing optimism surrounding the future of digital currencies has led to increased investor confidence, resulting in higher demand for ETH. Additionally, the recent surge in DeFi (decentralized finance) projects has further fueled the demand for Ethereum, as many of these projects are built on the Ethereum platform.

ETH Supply and Demand

The supply and demand dynamics of ETH have also contributed to its price surge. With a maximum supply of 18 million ETH, the scarcity of the asset has made it more valuable. As the demand for ETH continues to grow, its price is expected to remain high. However, it’s important to note that the supply of ETH is gradually increasing due to the network’s inflationary model, which could potentially impact its long-term value.

Conclusion

In conclusion, the ETH coin price hitting history highs can be attributed to a combination of factors, including market dynamics, smart contracts and DApps, network expansion, institutional interest, regulatory environment, competition, market sentiment, and supply and demand. As the digital currency landscape continues to evolve, Ethereum remains a key player, with its price expected to remain strong in the near future.

| Factor | Impact on ETH Price |

|---|---|

| Smart Contracts and DApps | Increased demand for ETH |

| Network Expansion and Scalability | Improved user experience and reduced transaction fees |

| Institutional Interest |