Eth Coin MarketCap: A Comprehensive Overview

Are you curious about the world of cryptocurrencies? Have you ever wondered what makes Ethereum (ETH) such a significant player in the market? Well, you’ve come to the right place. In this detailed exploration, we’ll delve into the various aspects of Ethereum’s market capitalization, providing you with a comprehensive understanding of its current status and future potential.

Understanding Market Capitalization

Market capitalization, often abbreviated as market cap, is a measure of the total value of a company’s outstanding shares of stock. In the context of cryptocurrencies, it represents the total value of all coins in circulation. To calculate the market cap of Ethereum, we multiply the current price of ETH by the total number of coins in circulation.

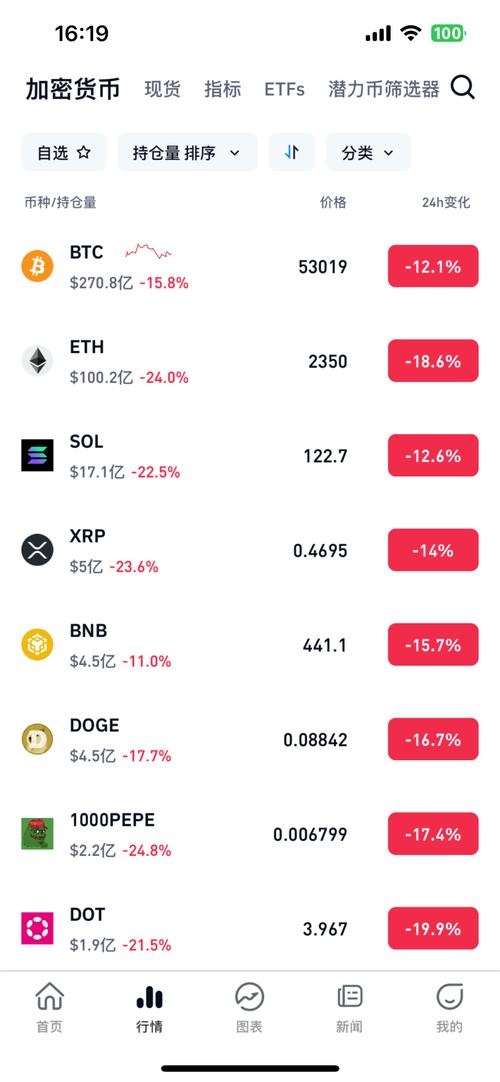

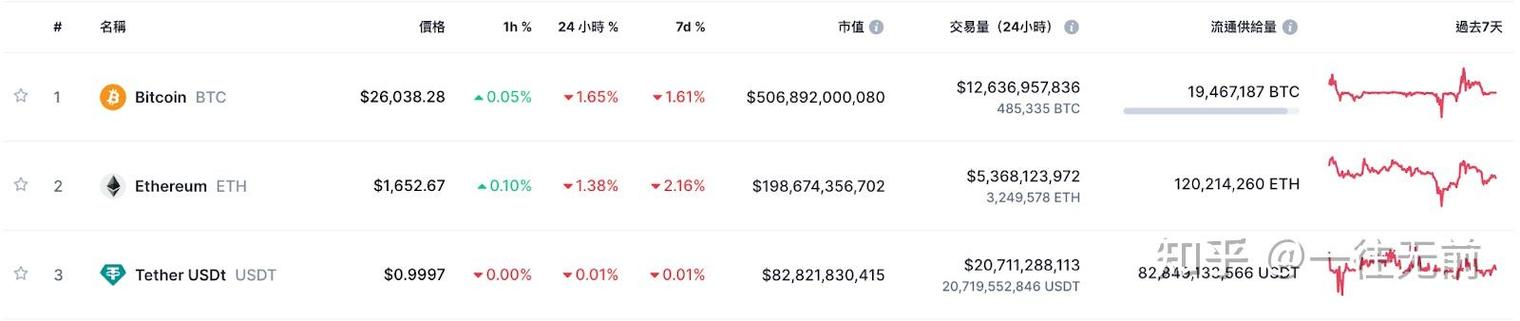

As of the latest data available, the total market capitalization of Ethereum stands at approximately $200 billion. This places it as the second-largest cryptocurrency by market cap, trailing only Bitcoin (BTC). However, it’s important to note that market capitalization can fluctuate significantly due to various factors, including market sentiment, regulatory news, and technological advancements.

The Current Price of ETH

The current price of Ethereum is a crucial factor in determining its market capitalization. As of this writing, the price of ETH is hovering around $1,800. This price is influenced by a multitude of factors, including supply and demand dynamics, technological developments, and broader market trends.

It’s worth noting that the price of ETH has experienced significant volatility over the years. In 2017, for instance, the price of ETH surged to an all-time high of nearly $1,400. However, it has since experienced periods of decline and recovery. Understanding the factors that drive the price of ETH is essential for anyone interested in its market capitalization.

The Total Supply of ETH

The total supply of Ethereum coins in circulation is another critical factor in determining its market capitalization. As of now, there are approximately 118 million ETH coins in circulation. However, it’s important to note that Ethereum has a maximum supply limit of 18 million coins, which is expected to be reached by the year 2140.

This maximum supply limit is a unique feature of Ethereum, as it aims to prevent inflation and maintain the value of the currency over time. The limited supply of ETH has contributed to its status as a valuable asset in the cryptocurrency market.

Market Dynamics and Trends

Understanding the market dynamics and trends surrounding Ethereum is crucial for anyone interested in its market capitalization. Several factors can influence the market capitalization of ETH, including:

-

Supply and demand: The balance between the number of ETH coins available and the demand for them can significantly impact the price and, consequently, the market capitalization.

-

Technological advancements: Ethereum’s ongoing development, including improvements to its blockchain and the introduction of new features, can influence its market capitalization.

-

Regulatory news: Changes in regulations regarding cryptocurrencies can have a significant impact on market sentiment and, subsequently, the market capitalization of ETH.

-

Broader market trends: The overall performance of the cryptocurrency market, as well as traditional financial markets, can influence the market capitalization of ETH.

Ethereum’s Unique Selling Points

Ethereum has several unique selling points that have contributed to its success and market capitalization. Some of these include:

-

Smart contracts: Ethereum’s ability to facilitate smart contracts has made it a popular platform for decentralized applications (dApps) and decentralized finance (DeFi) projects.

-

Scalability: Ethereum is continuously working on improving its scalability, which is essential for supporting a growing number of users and transactions.

-

Community support: Ethereum has a strong and active community of developers, investors, and enthusiasts, which has contributed to its growth and market capitalization.

Conclusion

Ethereum’s market capitalization is a testament to its significance in the cryptocurrency market. With a current market cap of approximately $200 billion, ETH is a valuable asset for investors and a popular platform for developers. As the cryptocurrency market continues to evolve, it will be interesting to see how Ethereum’s market capitalization changes and what new developments will shape its future.

| Factor | Impact on Market Capitalization |

|---|