Eth Defined: A Comprehensive Overview

Have you ever wondered what exactly “ETH” stands for in the world of cryptocurrencies? Well, you’re in for a treat as we delve into the multifaceted definition of ETH, exploring its origins, functionality, and impact on the digital landscape.

Origins of ETH

ETH, short for Ethereum, was introduced in 2015 by Vitalik Buterin, a Russian-Canadian programmer. It was designed as a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (DApps). Unlike Bitcoin, which is primarily a digital currency, Ethereum is a blockchain platform that supports various applications beyond just financial transactions.

Functionality of ETH

ETH serves as the native cryptocurrency of the Ethereum network. It plays a crucial role in the ecosystem, acting as a medium of exchange, a reward for miners, and a means of paying for transaction fees. Here’s a breakdown of its key functionalities:

-

Medium of Exchange: ETH can be used to purchase goods and services from merchants who accept it as payment. This includes everything from digital goods to physical products.

-

Reward for Miners: Miners are individuals who validate transactions on the Ethereum network and secure the blockchain. They are rewarded with ETH for their efforts.

-

Transaction Fees: When you send ETH or interact with a DApp, you’ll need to pay a small fee to cover the network’s computational costs. This fee is denoted in ETH and is paid to the miners who process the transaction.

Smart Contracts and DApps

One of the most significant contributions of Ethereum is the concept of smart contracts. These are self-executing contracts with the terms of the agreement directly written into lines of code. They run on the blockchain and automatically enforce and execute the terms of the agreement, eliminating the need for intermediaries. This has paved the way for the development of DApps, which are applications built on top of the Ethereum platform.

Smart contracts have numerous applications, including:

-

Decentralized Finance (DeFi): DeFi platforms use smart contracts to create decentralized financial services, such as lending, borrowing, and trading, without the need for traditional financial intermediaries.

-

Supply Chain Management: Smart contracts can be used to track and verify the movement of goods and services, ensuring transparency and efficiency in supply chain operations.

-

Real Estate: Smart contracts can facilitate the buying, selling, and transferring of real estate assets, reducing the need for intermediaries and streamlining the process.

ETH as a Store of Value

ETH has also gained popularity as a store of value, similar to Bitcoin. Its limited supply, deflationary nature, and increasing demand have contributed to its rise in value over the years. Many investors view ETH as a long-term investment, similar to gold or other precious metals.

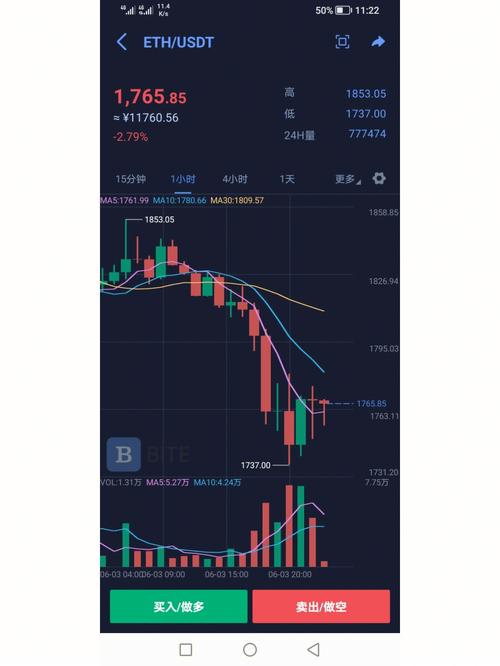

Market Performance

Since its inception, ETH has experienced significant growth in value. In 2015, when it was launched, one ETH was worth just a few cents. As of 2021, its value had surged to over $4,000. This dramatic increase in value has made ETH one of the most valuable cryptocurrencies in the market.

ETH 2.0

As the Ethereum network continues to grow, it faces scalability challenges. To address this, the Ethereum Foundation has proposed Ethereum 2.0, a major upgrade to the network. ETH 2.0 aims to improve the network’s scalability, security, and sustainability. The upgrade will transition Ethereum from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism, reducing energy consumption and improving transaction speeds.

Conclusion

In conclusion, ETH is much more than just a cryptocurrency. It’s a decentralized platform that has revolutionized the way we think about digital transactions and applications. With its versatile functionality, growing market value, and innovative features like smart contracts and DApps, ETH has become an essential part of the digital landscape. As the world continues to embrace blockchain technology, ETH is poised to play a significant role in shaping the future of finance and beyond.