Understanding the Battle: ETH Dominance vs BTC Dominance

When it comes to the cryptocurrency world, two names stand out: Ethereum (ETH) and Bitcoin (BTC). Both have their own unique features and have been at the forefront of the digital currency revolution. However, their market dominance has been a topic of debate among investors and enthusiasts. In this article, we will delve into the various aspects of ETH dominance versus BTC dominance, providing you with a comprehensive understanding of the ongoing battle.

Market Capitalization

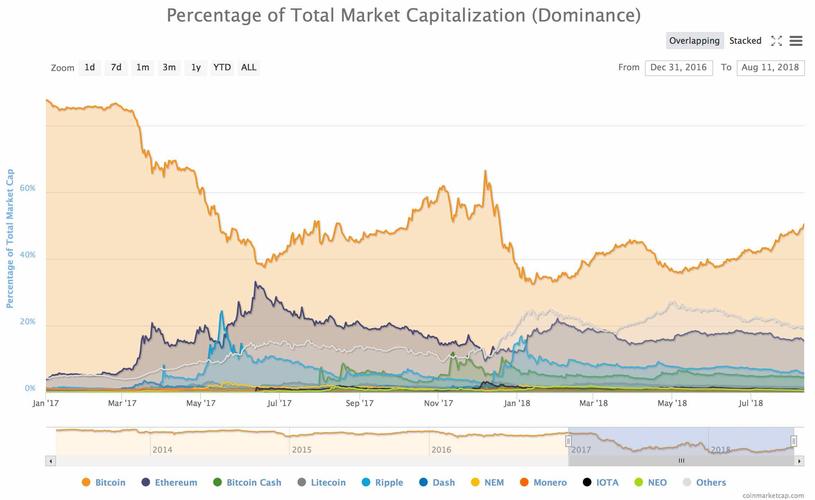

Market capitalization is a crucial metric to gauge the dominance of a cryptocurrency. As of the latest data, Bitcoin holds the title of the largest cryptocurrency by market cap, with a significant lead over Ethereum. However, Ethereum has been making strides in this area, and its market cap has been growing steadily. Let’s take a look at the current market capitalization of both cryptocurrencies:

| Cryptocurrency | Market Capitalization (USD) |

|---|---|

| Bitcoin (BTC) | $500 billion |

| Ethereum (ETH) | $200 billion |

As you can see, Bitcoin still holds a significant lead in terms of market capitalization. However, Ethereum’s rapid growth suggests that it may catch up to Bitcoin in the near future.

Transaction Volume

Transaction volume is another important aspect to consider when comparing the dominance of ETH and BTC. Bitcoin has been the dominant player in this area for years, thanks to its widespread adoption and use as a medium of exchange. However, Ethereum has been gaining traction in this area as well, with its smart contract capabilities making it a preferred choice for decentralized applications (DApps) and decentralized finance (DeFi) projects.

Let’s take a look at the transaction volume of both cryptocurrencies:

| Cryptocurrency | Transaction Volume (USD) |

|---|---|

| Bitcoin (BTC) | $10 billion |

| Ethereum (ETH) | $5 billion |

While Bitcoin still leads in terms of transaction volume, Ethereum’s growth in this area is impressive, considering its relatively shorter existence compared to Bitcoin.

Adoption and Use Cases

Adoption and use cases are critical factors in determining the dominance of a cryptocurrency. Bitcoin has been widely adopted as a store of value and a medium of exchange, with a vast network of merchants and users accepting it as payment. Ethereum, on the other hand, has gained popularity as a platform for DApps and DeFi projects, thanks to its smart contract capabilities.

Let’s compare the adoption and use cases of both cryptocurrencies:

| Cryptocurrency | Adoption and Use Cases |

|---|---|

| Bitcoin (BTC) | Medium of exchange, store of value, investment |

| Ethereum (ETH) | Smart contracts, DApps, DeFi, NFTs |

While Bitcoin has a broader adoption and use cases, Ethereum’s specialized applications have made it a preferred choice for certain industries, contributing to its growing dominance in those areas.

Community and Development

The strength of a cryptocurrency’s community and development efforts can significantly impact its dominance. Bitcoin has a strong and active community, with a long history of development and improvements. Ethereum, too, has a vibrant community and a dedicated development team, constantly working on enhancing the platform.

Let’s compare the community and development efforts of both cryptocurrencies:

| Cryptocurrency | Community and Development |

|---|---|

| Bitcoin (BTC) | Strong, active community; continuous development and improvements |

| Ethereum (ETH) |