Are you curious about the world of Ethereum (ETH)? Have you ever wondered what 100 ETH is worth? In this article, we’ll delve into the intricacies of ETH, exploring its value, market dynamics, and how it compares to other cryptocurrencies. Let’s embark on this journey together.

Understanding Ethereum (ETH)

Ethereum, often abbreviated as ETH, is a decentralized blockchain platform that enables the creation of smart contracts and decentralized applications (DApps). Unlike Bitcoin, which is primarily a digital currency, ETH serves as a fuel for DApps and smart contracts, providing the necessary computational resources.

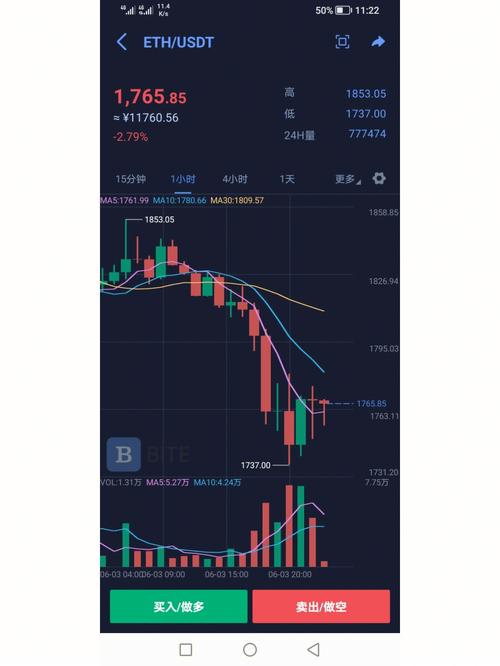

ETH’s value is closely tied to market demand. During the 2017-2018 bull run, ETH reached an all-time high of around $1400 per coin. However, during bear markets, its value plummeted to less than $100. Currently, ETH’s price has surged nearly threefold compared to the beginning of the year.

Factors Influencing ETH Price

The price of ETH, like any cryptocurrency, is influenced by various factors, including market supply and demand, government policies, technological advancements, and regulatory changes.

One significant factor is the continuous development of blockchain technology. The rise of DeFi applications has further highlighted the value of ETH as a digital currency and a necessary resource for DApps. As more DApps are launched, the demand for ETH is expected to increase, driving up its price.

Government policies also play a crucial role in ETH’s price. For instance, China’s ban on ICOs in 2017 caused a significant downturn in the global cryptocurrency market. Similarly, news about government policies and central bank digital currency issuance can lead to price volatility.

Calculating the Value of 100 ETH

As of now, the price of ETH is fluctuating between $2000 and $2500. To calculate the value of 100 ETH, you can multiply the current price by 100. For example, if the price is $2000, 100 ETH would be worth $200,000. However, keep in mind that prices can change rapidly, so it’s essential to check the latest market data.

Comparing ETH to Other Cryptocurrencies

When comparing ETH to other cryptocurrencies, it’s essential to consider factors such as market capitalization, trading volume, and use cases.

Bitcoin (BTC) is the largest cryptocurrency by market capitalization, followed by ETH. While BTC is primarily a digital currency, ETH serves as a platform for DApps and smart contracts. This distinction makes ETH a unique asset with its own set of use cases.

Other popular cryptocurrencies, such as Ripple (XRP) and Litecoin (LTC), have different use cases and market dynamics. For instance, XRP is often used for cross-border payments, while LTC is known for its faster transaction times.

ETH Price Prediction and Future Outlook

Predicting the future price of ETH is challenging, as it depends on various factors, including market sentiment, technological advancements, and regulatory changes. However, some experts believe that ETH has the potential to become a dominant player in the cryptocurrency market.

One of the key factors driving ETH’s potential growth is its increasing adoption in the DeFi space. As more DApps are developed and launched, the demand for ETH is expected to rise, potentially driving up its price.

Conclusion

Ethereum (ETH) is a fascinating cryptocurrency with a wide range of use cases. Understanding its value, market dynamics, and potential future growth can help you make informed decisions about your investments. Whether you’re a seasoned investor or just starting out, exploring the world of ETH can be a rewarding experience.