ETH 2.0 IPO: A Comprehensive Guide for Investors

Are you considering investing in the Ethereum 2.0 Initial Public Offering (IPO)? If so, you’ve come to the right place. Ethereum 2.0, also known as Eth2, is a highly anticipated upgrade to the Ethereum network, promising significant improvements in scalability, security, and sustainability. In this article, we’ll delve into the details of the Eth2 IPO, covering everything from its potential benefits to the risks involved.

Understanding Ethereum 2.0

Ethereum 2.0 is a major upgrade to the Ethereum network, designed to address its current limitations. The primary goals of Eth2 are to increase the network’s scalability, improve its security, and make it more energy-efficient. Here’s a brief overview of the key features of Ethereum 2.0:

- Proof of Stake (PoS): Ethereum 2.0 will transition from Proof of Work (PoW) to Proof of Stake, which is more energy-efficient and reduces the risk of centralization.

- Sharding: The network will be divided into smaller, more manageable shards, allowing for faster and more efficient transactions.

- Improved Security: Eth2 will implement various security enhancements, such as cross-shard communication and improved consensus mechanisms.

- Energy Efficiency: By moving to PoS, Ethereum 2.0 aims to significantly reduce its energy consumption.

The Eth2 IPO: What You Need to Know

The Eth2 IPO is expected to be a significant event for the Ethereum community and investors alike. Here’s what you need to know about the IPO:

1. How the IPO Works

The Eth2 IPO will likely involve a token sale, where investors can purchase Eth2 tokens in exchange for fiat currency or other cryptocurrencies. The tokens will represent a share of the Ethereum 2.0 network, allowing investors to participate in its governance and potential profits.

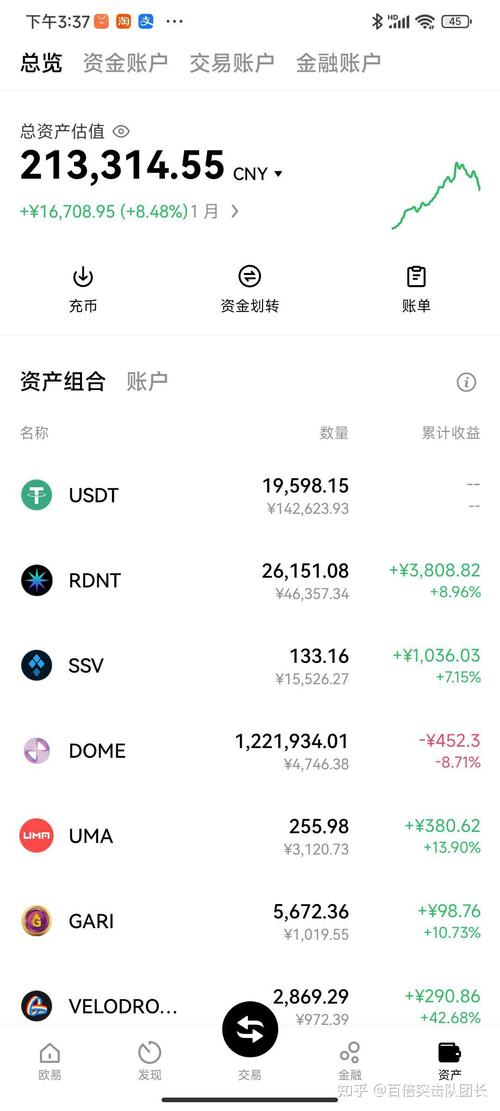

2. The Token Allocation

The Eth2 token allocation is expected to be as follows:

| Allocation | Percentage |

|---|---|

| Community Treasury | 10% |

| Foundation Treasury | 10% |

| Staking Rewards | 60% |

| Investors | 20% |

3. The Potential Benefits

Investing in the Eth2 IPO can offer several potential benefits:

- Participation in Governance: Investors will have a say in the future of the Ethereum network.

- Staking Rewards: Investors can earn rewards by staking their Eth2 tokens.

- Long-term Growth: Ethereum 2.0 is expected to drive significant growth in the Ethereum ecosystem.

The Risks Involved

While the Eth2 IPO presents potential benefits, it’s important to be aware of the risks involved:

1. Regulatory Uncertainty

The regulatory landscape for cryptocurrencies is still evolving, and there’s a risk that Eth2 tokens could be deemed as securities, which could impact their legality and liquidity.

2. Technical Risks

Ethereum 2.0 is a complex upgrade, and there’s a risk that technical issues could arise, potentially impacting the network’s performance and value.

3. Market Volatility

Cryptocurrencies are known for their volatility, and the value of Eth2 tokens could fluctuate significantly in the short term.

Conclusion

Investing in the Eth2 IPO can be an exciting opportunity for investors looking to participate in the future of the Ethereum network. However, it’s important to carefully consider the potential benefits and risks before making any investment decisions. By doing your research and understanding the intricacies of Ethereum 2.0, you can make an informed decision about whether the Eth2 IPO is right for you.