Understanding the Eth 2 Price Prediction: A Comprehensive Guide

Are you intrigued by the potential of Ethereum 2.0 and want to know more about its price prediction? Look no further! In this detailed guide, we will delve into the various dimensions that contribute to the Eth 2 price prediction, providing you with a comprehensive understanding of the factors at play.

Market Analysis

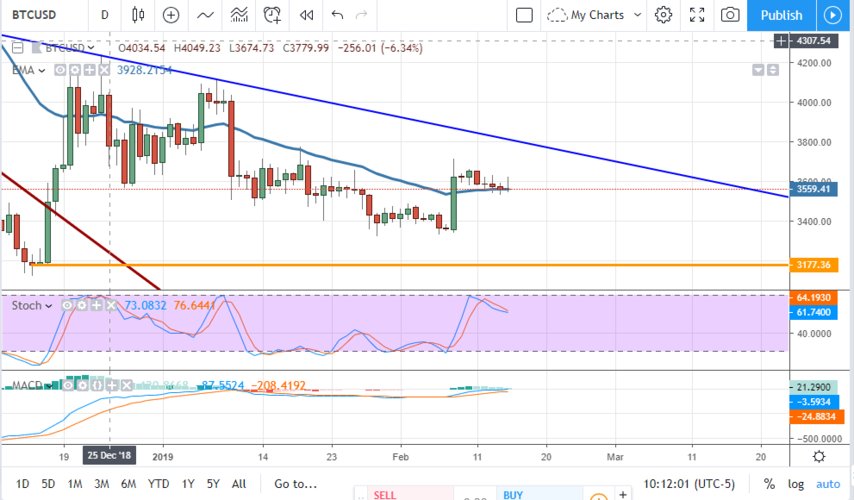

When it comes to predicting the price of Ethereum 2.0, market analysis plays a crucial role. By examining historical data, current market trends, and future projections, we can gain insights into the potential price movements.

Historical data shows that Ethereum has experienced significant growth since its inception. By analyzing past price patterns, we can identify trends and patterns that may influence future price movements. Additionally, current market trends, such as the overall demand for Ethereum and its competitors, can provide valuable information.

Future projections, on the other hand, involve considering various factors that may impact the Ethereum 2.0 price. These factors include technological advancements, regulatory changes, and market sentiment. By analyzing these projections, we can gain a better understanding of the potential price trajectory.

Supply and Demand Dynamics

Supply and demand dynamics are fundamental in determining the price of any asset, including Ethereum 2.0. Let’s explore the key factors that influence supply and demand in the Ethereum ecosystem.

Supply: The supply of Ethereum 2.0 is determined by the Ethereum network’s mining process. As more miners join the network, the supply of Ethereum 2.0 increases. However, the Ethereum network has implemented a supply cap, which limits the total supply of Ethereum 2.0. This scarcity can drive up the price if demand outpaces supply.

Demand: The demand for Ethereum 2.0 is influenced by various factors, including its use cases, technological advancements, and market sentiment. For instance, the increasing adoption of Ethereum as a decentralized finance (DeFi) platform has significantly boosted its demand. Additionally, technological advancements, such as the Ethereum 2.0 upgrade, can attract more users and investors, further driving up demand.

Technological Advancements

Technological advancements play a crucial role in shaping the future of Ethereum 2.0 and its price. Let’s explore some of the key technological factors that can impact the price prediction.

Ethereum 2.0 Upgrade: The Ethereum 2.0 upgrade is a significant technological advancement that aims to improve scalability, security, and sustainability. By transitioning to a proof-of-stake consensus mechanism, Ethereum 2.0 aims to address the limitations of the current proof-of-work mechanism. This upgrade is expected to attract more users and investors, potentially driving up the price.

Smart Contract Capabilities: Ethereum’s smart contract capabilities have been a major driver of its adoption. As the Ethereum network continues to evolve and introduce new features, it can attract more developers and businesses, increasing demand for Ethereum 2.0 and potentially driving up its price.

Regulatory Environment

The regulatory environment plays a crucial role in shaping the price of Ethereum 2.0. Let’s explore the key regulatory factors that can impact the price prediction.

Regulatory Changes: Regulatory changes can have a significant impact on the Ethereum ecosystem. For instance, if a country implements strict regulations on cryptocurrencies, it may negatively impact the demand for Ethereum 2.0 and potentially drive down its price. Conversely, favorable regulations can boost demand and drive up the price.

Global Economic Conditions: Global economic conditions, such as inflation rates, interest rates, and currency fluctuations, can also influence the price of Ethereum 2.0. In times of economic uncertainty, investors may turn to cryptocurrencies as a safe haven, potentially driving up the price.

Market Sentiment

Market sentiment is a crucial factor in determining the price of Ethereum 2.0. Let’s explore the key factors that can influence market sentiment.

Media Influence: Media coverage and public perception can significantly impact market sentiment. Positive news, such as successful Ethereum 2.0 upgrades or partnerships, can boost investor confidence and drive up the price. Conversely, negative news can lead to a sell-off and drive down the price.

Investor Behavior: The behavior of investors, including whales and retail traders, can also influence market sentiment. Large-scale buyouts or sell-offs can cause significant price volatility.

Conclusion

In conclusion, predicting the price of Ethereum 2.0 involves analyzing various dimensions, including market analysis, supply and demand dynamics, technological advancements, regulatory environment, and market sentiment. By considering these factors, we can gain a better understanding of