Eth 2.0 Investment: A Comprehensive Guide for Aspiring Investors

Investing in Ethereum 2.0 can be a lucrative venture, but it’s crucial to understand the intricacies and potential risks involved. In this article, we’ll delve into the various aspects of Eth 2.0 investment, providing you with the knowledge to make informed decisions.

Understanding Ethereum 2.0

Ethereum 2.0, also known as Eth 2.0, is the highly anticipated upgrade to the Ethereum network. It aims to address several limitations of the current system, such as scalability, security, and decentralization. By shifting to a proof-of-stake consensus mechanism, Eth 2.0 aims to achieve a more energy-efficient and sustainable network.

The Benefits of Investing in Eth 2.0

Investing in Eth 2.0 can offer several benefits:

| Benefits | Description |

|---|---|

| Scalability | Eth 2.0 introduces sharding, allowing for parallel processing of transactions, which can significantly improve network scalability. |

| Security | The proof-of-stake mechanism reduces the risk of 51% attacks, making the network more secure. |

| Decentralization | Eth 2.0 aims to increase the number of validators, ensuring a more decentralized network. |

| Energy Efficiency | The proof-of-stake mechanism consumes significantly less energy compared to the current proof-of-work system. |

The Risks of Investing in Eth 2.0

While investing in Eth 2.0 offers numerous benefits, it’s essential to be aware of the potential risks:

| Risks | Description |

|---|---|

| Market Volatility | The cryptocurrency market is highly volatile, and Eth 2.0 investments are no exception. |

| Regulatory Risks | Changes in regulations can impact the value of Eth 2.0 investments. |

| Technical Challenges | The transition to Eth 2.0 may face technical challenges, which could affect the network’s performance. |

How to Invest in Eth 2.0

Investing in Eth 2.0 involves several steps:

-

Research and educate yourself about Ethereum 2.0 and its potential benefits and risks.

-

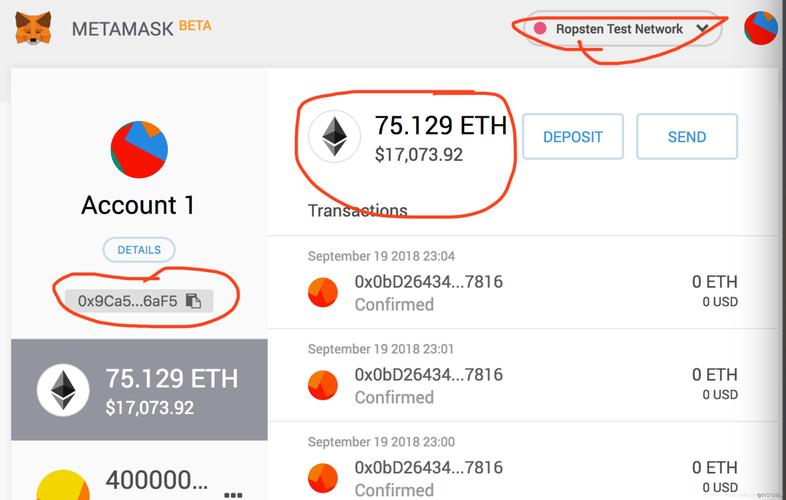

Choose a reputable cryptocurrency exchange or wallet to store your Eth 2.0 investments.

-

Understand the different ways to invest in Eth 2.0, such as staking, liquidity mining, or purchasing Eth 2.0 tokens.

-

Decide on the amount of capital you’re willing to invest and allocate it accordingly.

-

Stay informed about the latest developments in the Eth 2.0 ecosystem to make informed decisions.

Staking in Eth 2.0

One of the most popular ways to invest in Eth 2.0 is through staking. Staking involves locking up your Ethereum tokens to participate in the network’s consensus process and earn rewards. Here’s a brief overview of staking in Eth 2.0:

-

Choose a staking provider or validator to manage your staked tokens.

-

Lock up your Ethereum tokens for a specific duration, typically 6 months to 1 year.

-

Receive rewards in the form of additional Ethereum tokens, known as staking rewards.

Conclusion

Investing in Eth 2.0 can be a rewarding experience, but it’s crucial to conduct thorough research and understand the associated risks. By following the