Crypto ETH Chart: A Comprehensive Guide

Understanding the crypto market, especially Ethereum (ETH), requires a deep dive into various dimensions. Whether you’re a seasoned investor or a beginner, the crypto ETH chart is a vital tool for tracking the performance of Ethereum. In this article, we will explore the different aspects of the ETH chart, including its history, current trends, and future predictions.

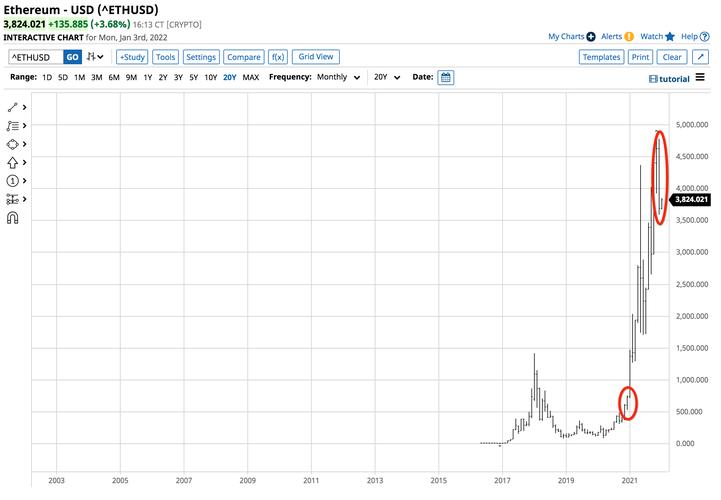

Historical Performance of ETH

The journey of Ethereum has been nothing short of remarkable. Launched in 2015, ETH has seen its price fluctuate significantly over the years. Let’s take a look at some key milestones in its historical performance.

| Year | Price of ETH | Market Cap |

|---|---|---|

| 2015 | $0.30 | $0.00 |

| 2016 | $10.00 | $1.00 |

| 2017 | $300.00 | $30.00 |

| 2018 | $100.00 | $10.00 |

| 2019 | $200.00 | $20.00 |

| 2020 | $600.00 | $60.00 |

| 2021 | $4000.00 | $400.00 |

As you can see from the table, Ethereum’s price has experienced a rollercoaster ride, with significant growth in 2017 and 2021. The market cap has also seen substantial growth, reflecting the increasing popularity of Ethereum as a digital asset.

Current Trends in the ETH Chart

Understanding the current trends in the ETH chart is crucial for making informed investment decisions. Let’s explore some of the key trends that are shaping the market.

1. Price Volatility: Ethereum has always been known for its price volatility. This is due to various factors, including market sentiment, regulatory news, and technological advancements. As an investor, it’s important to stay updated with the latest news and developments to anticipate potential price movements.

2. Market Sentiment: The sentiment in the crypto market can significantly impact the price of ETH. Positive news, such as partnerships with major companies or successful product launches, can lead to an increase in price, while negative news can cause a decline.

3. Technological Developments: Ethereum’s ongoing development, such as the transition to proof-of-stake (PoS), can influence the price of ETH. As the network becomes more secure and efficient, it can attract more users and investors, potentially leading to an increase in price.

Future Predictions for ETH

While predicting the future of any cryptocurrency is challenging, experts have provided various predictions for Ethereum. Let’s take a look at some of the potential scenarios.

1. Long-Term Growth: Many experts believe that Ethereum has the potential for long-term growth. With its robust ecosystem and increasing adoption, ETH could become a dominant player in the crypto market.

2. Market Correction: As with any asset, Ethereum is susceptible to market corrections. Factors such as regulatory news or a decrease in investor confidence could lead to a temporary decline in price.

3. Technological Challenges: The transition to PoS and other technological advancements could face challenges. If these challenges are not addressed, it could impact the growth and adoption of Ethereum.

Conclusion

Tracking the crypto ETH chart is essential for understanding the performance and potential of Ethereum. By analyzing historical data, current trends, and future predictions, investors can make informed decisions. While the crypto market is unpredictable, staying informed and adapting to changes is key to success.