Understanding the 0.14 ETH Price: A Comprehensive Overview

When it comes to cryptocurrencies, the value of individual coins can fluctuate wildly. One such coin is Ethereum (ETH), which has seen its price rise and fall over the years. In this article, we’ll delve into the intricacies of the 0.14 ETH price, exploring various factors that influence its value and providing you with a detailed understanding of what this price represents.

What is Ethereum (ETH)?

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of downtime, fraud, or third-party interference. The native cryptocurrency of the Ethereum platform is called Ether (ETH). It is used to pay for transaction fees and services on the network.

Understanding the 0.14 ETH Price

The 0.14 ETH price refers to the value of 0.14 Ethereum in terms of fiat currency, such as USD or EUR. This price can vary depending on the exchange you’re using, the time of day, and market conditions. Let’s explore some of the factors that can influence this price:

| Factor | Description |

|---|---|

| Market Supply and Demand | The basic principle of supply and demand applies to cryptocurrencies as well. If there’s high demand for ETH and a limited supply, the price will likely increase. Conversely, if there’s more supply than demand, the price may decrease. |

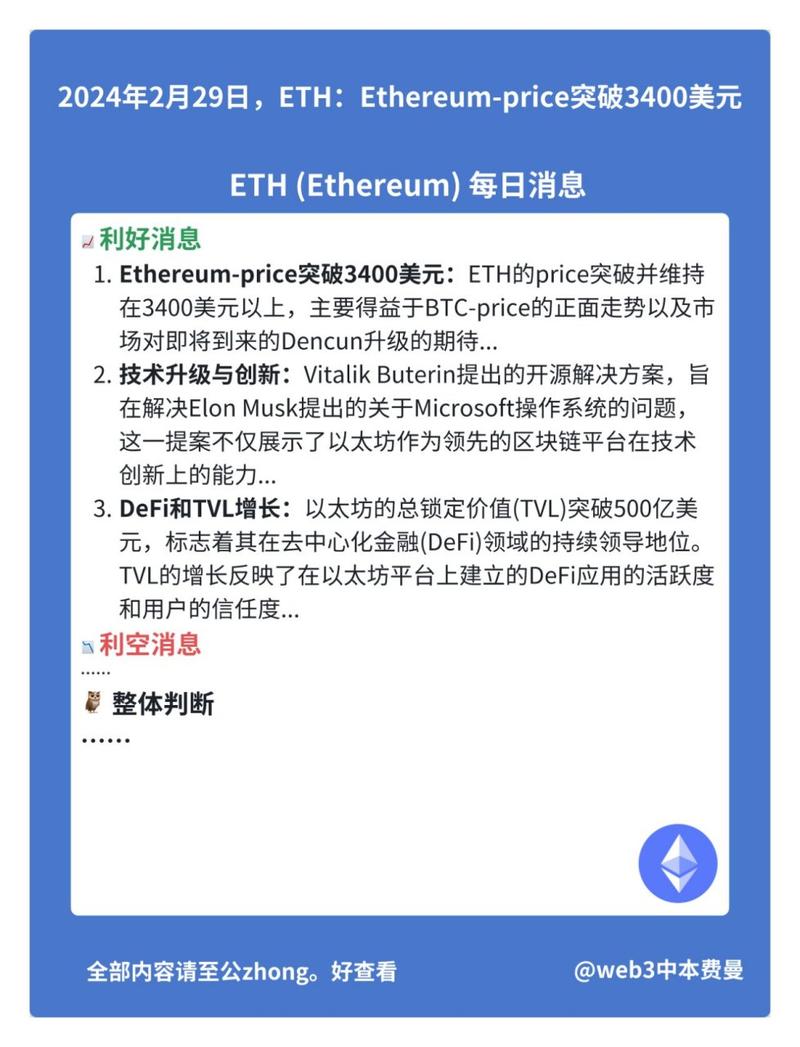

| Market Sentiment | Investor confidence and sentiment can significantly impact the price of ETH. Positive news, such as partnerships or technological advancements, can drive the price up, while negative news, such as regulatory concerns or security breaches, can cause it to fall. |

| Market Competition | The rise of other cryptocurrencies, such as Bitcoin (BTC) or Binance Coin (BNB), can affect the demand for ETH. If investors are attracted to these alternative assets, it may lead to a decrease in ETH’s price. |

| Technological Developments | Advancements in Ethereum’s technology, such as the upcoming Ethereum 2.0 upgrade, can influence the price. If the upgrades are successful and improve the network’s efficiency, it may lead to an increase in ETH’s value. |

| Market Volatility | Cryptocurrencies are known for their high volatility. This means that the price can change rapidly, sometimes by large percentages, in a short period of time. This volatility can make the 0.14 ETH price fluctuate significantly. |

How to Track the 0.14 ETH Price

Keeping an eye on the 0.14 ETH price is essential if you’re considering investing in Ethereum. Here are some ways to track the price:

-

Use cryptocurrency exchanges: Many exchanges, such as Coinbase, Binance, and Kraken, provide real-time price updates for ETH.

-

Check crypto news websites: Websites like CoinDesk, CoinTelegraph, and CryptoSlate offer up-to-date information on the crypto market, including price charts and news.

-

Download crypto price tracking apps: Apps like CoinMarketCap and CryptoCompare allow you to track the price of ETH and other cryptocurrencies on the go.

Investing in 0.14 ETH

Before investing in 0.14 ETH, it’s essential to do your research and understand the risks involved. Here are some tips to consider:

-

Understand the market: Familiarize yourself with the factors that influence the price of ETH and how they can affect your investment.

-

Set a budget: Decide how much you’re willing to invest in ETH and stick to it.

-

Choose a secure wallet: Store your ETH in a secure wallet to protect your investment from theft.

-

Stay informed: Keep up with the latest news and developments in the crypto market to make informed decisions.

Conclusion

Understanding the 0.14 ETH price requires a comprehensive