Understanding the 0.05 ETH Price: A Comprehensive Overview

When it comes to cryptocurrencies, the value of individual units can fluctuate wildly. One such unit is the Ethereum (ETH), a popular digital currency that has seen significant growth in recent years. In this article, we will delve into the intricacies of the 0.05 ETH price, exploring various factors that influence its value and providing you with a comprehensive overview.

Market Dynamics

The price of 0.05 ETH is influenced by a multitude of factors, including market dynamics, supply and demand, and external economic conditions. To understand the current value of 0.05 ETH, it is essential to consider these factors in detail.

| Factor | Description |

|---|---|

| Market Dynamics | The overall trend in the cryptocurrency market can significantly impact the value of 0.05 ETH. For instance, during bull markets, the price of ETH tends to rise, while bear markets can lead to a decline in value. |

| Supply and Demand | The balance between the number of ETH tokens available and the demand for these tokens plays a crucial role in determining the price of 0.05 ETH. If demand exceeds supply, the price will likely increase, and vice versa. |

| External Economic Conditions | Global economic events, such as changes in interest rates, inflation, or political instability, can also affect the price of 0.05 ETH. These events can lead to increased demand for safe-haven assets, including cryptocurrencies. |

Historical Price Analysis

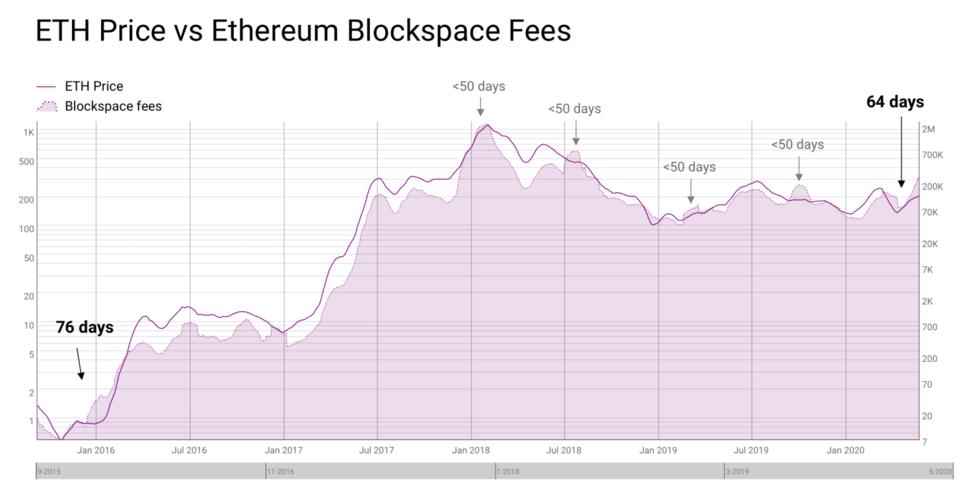

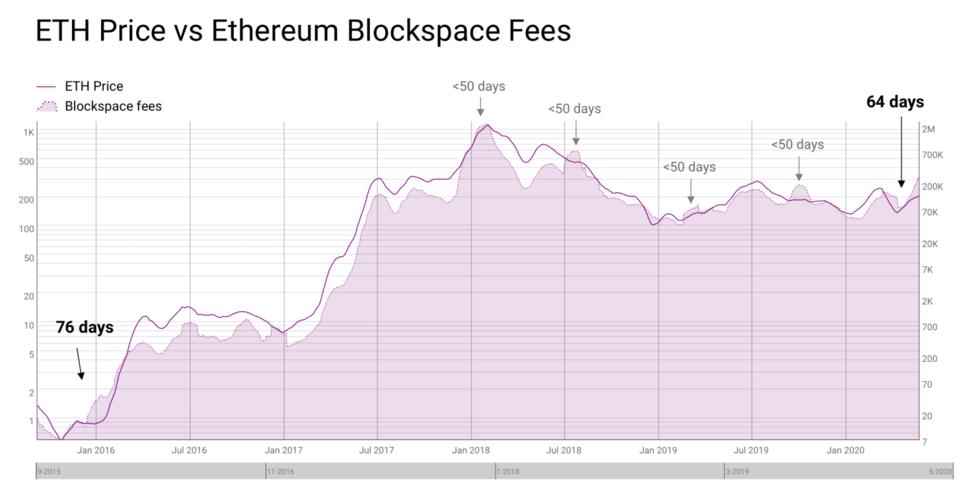

Looking at the historical price of 0.05 ETH can provide valuable insights into its value over time. By examining past trends, we can better understand the factors that have influenced its price and predict potential future movements.

For instance, in the past few years, the price of 0.05 ETH has experienced significant volatility. In early 2020, the price was around $2.50, but it surged to over $30 in late 2020 and early 2021. Since then, the price has fluctuated, reaching a high of $50 in May 2021 before dropping to around $30 in June 2021.

Market Sentiment

Market sentiment is a critical factor that can influence the price of 0.05 ETH. Positive news, such as partnerships between major companies and Ethereum, or regulatory developments that support the growth of cryptocurrencies, can lead to increased demand and a rise in price. Conversely, negative news, such as regulatory crackdowns or security breaches, can cause the price to fall.

Technical Analysis

Technical analysis involves studying historical price data and using various tools and indicators to predict future price movements. By analyzing the price of 0.05 ETH through technical analysis, we can gain a better understanding of its potential future value.

One popular technical indicator is the Relative Strength Index (RSI), which measures the speed and change of price movements. An RSI value above 70 indicates that a cryptocurrency is overbought, while a value below 30 suggests it is oversold. As of the latest data, the RSI for 0.05 ETH is around 50, indicating a neutral market sentiment.

Conclusion

In conclusion, the 0.05 ETH price is influenced by a variety of factors, including market dynamics, supply and demand, external economic conditions, market sentiment, and technical analysis. By understanding these factors, you can better predict the potential future value of 0.05 ETH and make informed investment decisions.