Understanding ETH at 0.369: A Comprehensive Guide

When it comes to Ethereum (ETH), the cryptocurrency world often fixates on its price fluctuations. At 0.369, ETH presents a unique opportunity to delve into its multifaceted nature. Let’s explore the various dimensions of ETH at this price point.

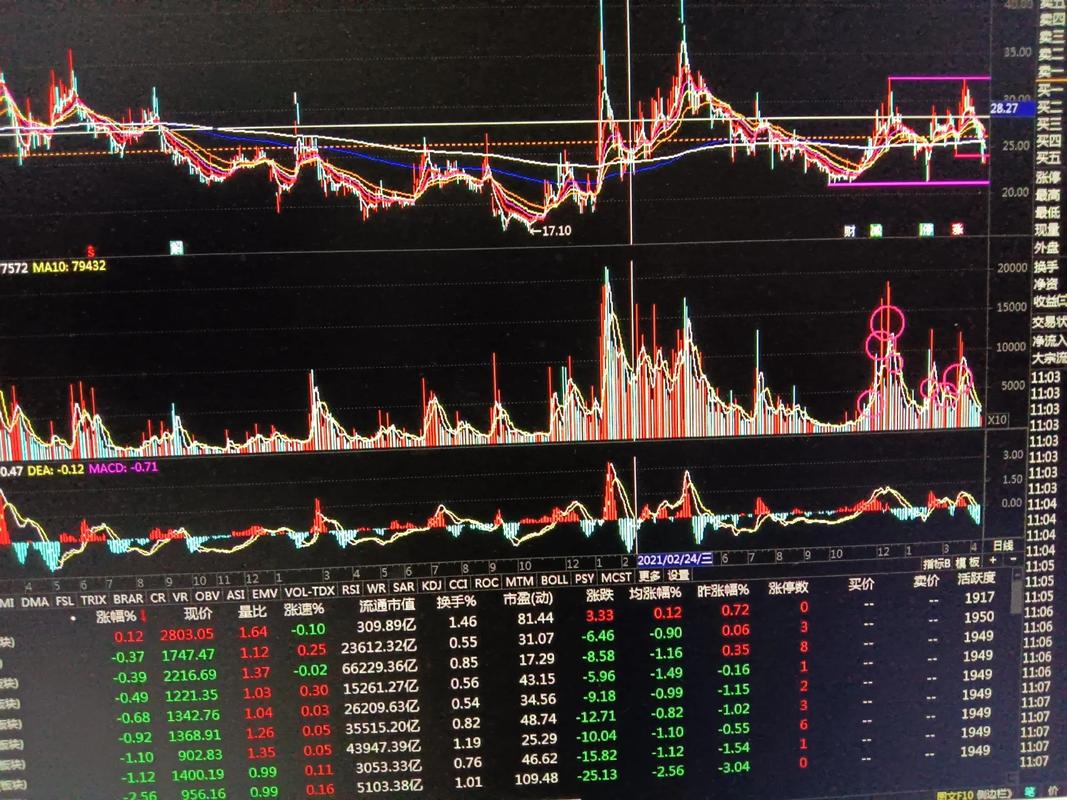

Historical Price Trends

Ethereum’s journey began in 2015 with an initial price of 0.31 USD. Over the years, ETH has experienced several ups and downs. In 2016, it reached a high of 2.8 USD before facing a downturn. However, 2017 marked a significant surge, with ETH skyrocketing to 730 USD by the end of the year. Unfortunately, 2018 saw a dramatic crash, with ETH plummeting to 85 USD. Despite this, 2019 brought stability, and 2020 witnessed a remarkable recovery. As of now, ETH is trading at 0.369, offering a glimpse into its current state.

Influencing Factors

Several factors contribute to ETH’s price at 0.369. One of the primary factors is the overall market sentiment. The cryptocurrency market’s volatility can significantly impact ETH’s value. Additionally, regulatory news, technological advancements, and macroeconomic factors play a crucial role. For instance, the Ethereum 2.0 upgrade and the rise of decentralized finance (DeFi) projects have positively influenced ETH’s price.

Market Analysis

At 0.369, ETH presents a compelling case for investors. The current price reflects a potential undervaluation, considering the ongoing developments in the Ethereum ecosystem. The DeFi boom and the increasing adoption of ETH as a transactional currency have contributed to its rising demand. Moreover, the upcoming Ethereum 2.0 upgrade is expected to enhance network scalability and efficiency, potentially driving ETH’s price higher.

Investment Opportunities

Investing in ETH at 0.369 can be a strategic move. However, it’s essential to conduct thorough research and consider the following factors:

-

Market Trends: Stay updated with the latest market trends and news to make informed decisions.

-

Technical Analysis: Utilize technical analysis tools to identify potential price movements.

-

Risk Management: Implement risk management strategies to protect your investment.

ETH鎸栫熆

ETH鎸栫熆 is another aspect to consider when analyzing ETH at 0.369. The profitability of ETH鎸栫熆 depends on several factors, including the current ETH price, electricity costs, and hardware efficiency. At this price point, it’s crucial to assess the potential ROI of ETH鎸栫熆 before investing in mining equipment.

ETH鎸栫熆绠楀姏

ETH鎸栫熆绠楀姏 is a measure of the computational power required to mine ETH. It is determined by the hardware used for mining. The higher the ETH鎸栫熆绠楀姏, the more likely you are to solve the mining puzzles and earn rewards. Here’s a table showcasing the ETH鎸栫熆绠楀姏 of popular GPUs:

| GPU Model | ETH鎸栫熆绠楀姏 (MH/s) |

|---|---|

| NVIDIA GeForce RTX 3080 | 100 |

| AMD Radeon RX 6800 XT | 80 |

| NVIDIA GeForce RTX 3060 Ti | 60 |

| AMD Radeon RX 5700 XT | 50 |

ETH鎸栫熆纭欢

ETH鎸栫熆 hardware is a crucial component in the mining process. The choice of hardware can significantly impact your mining profitability. Popular options include GPUs, ASICs, and FPGAs. Each type of hardware has its advantages and disadvantages, so it’s essential to choose the right one for your needs.

ETH鎸栫熆杞欢

ETH鎸栫熆 software is another critical factor to consider. There are several mining software options available, each with its unique features and capabilities. Some popular ETH鎸栫熆 software options include Claymore’s Dual Ethereum miner, Phoenix miner, and EWBF miner.