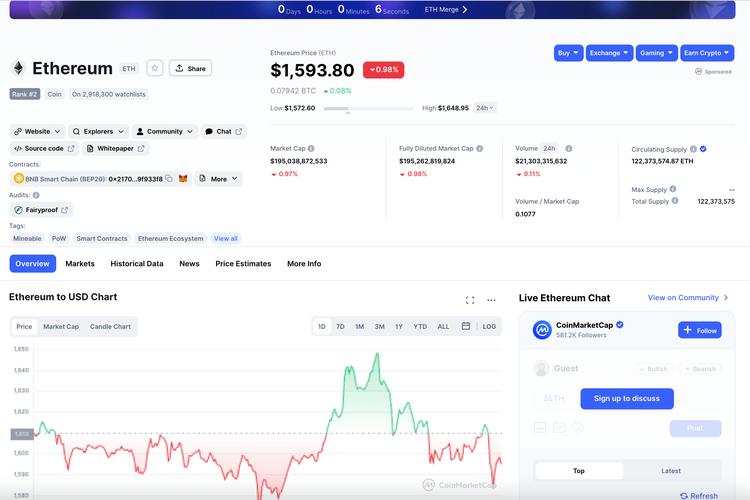

Ethereum ETH Chart: A Comprehensive Guide

When it comes to cryptocurrencies, Ethereum (ETH) stands out as one of the most influential and widely used digital assets. Its chart, often referred to as the Ethereum ETH chart, provides a visual representation of its price movements over time. In this article, we will delve into the various dimensions of the Ethereum ETH chart, offering you a detailed and insightful look into this vital aspect of the Ethereum ecosystem.

Understanding the Ethereum ETH Chart

The Ethereum ETH chart is a graphical representation of the price of Ethereum over a specific period. It typically includes a time axis on the horizontal line and a price axis on the vertical line. By analyzing this chart, you can gain valuable insights into the market trends, price volatility, and potential investment opportunities.

There are several types of Ethereum ETH charts available, each offering different perspectives and data points. Let’s explore some of the most common chart types:

-

Line Chart: This chart displays the price of Ethereum over time with a continuous line. It is useful for identifying long-term trends and patterns.

-

Bar Chart: This chart shows the opening, closing, highest, and lowest prices of Ethereum for a specific period. It is helpful for understanding short-term price movements and volatility.

-

OHLC Chart: This chart is similar to the bar chart but includes the opening, high, low, and closing prices. It is often used by traders to make informed decisions.

-

Candlestick Chart: This chart is similar to the OHLC chart but uses candlestick patterns to represent price movements. It is widely used by technical traders for analyzing market trends.

Interpreting the Ethereum ETH Chart

Interpreting the Ethereum ETH chart requires a combination of technical analysis and fundamental analysis. Here are some key aspects to consider:

Market Trends

Identifying market trends is crucial for making informed investment decisions. The Ethereum ETH chart can help you identify whether the market is in an uptrend, downtrend, or sideways trend. Uptrends are characterized by higher highs and higher lows, while downtrends are marked by lower highs and lower lows. Sideways trends occur when the price moves within a relatively narrow range.

Support and Resistance Levels

Support and resistance levels are critical price points where the market has repeatedly struggled to move below (support) or above (resistance). These levels can provide valuable insights into potential buying and selling opportunities. Traders often look for price movements near these levels to enter or exit positions.

Volatility

Volatility refers to the degree of price fluctuation in a given period. The Ethereum ETH chart can help you identify periods of high volatility, which may indicate increased uncertainty or market sentiment. High volatility can lead to significant price movements, both up and down, in a short period of time.

Technical Indicators

Technical indicators are mathematical tools used to analyze price movements and predict future market trends. Some popular technical indicators for the Ethereum ETH chart include moving averages, relative strength index (RSI), and Bollinger Bands. These indicators can provide additional insights into the market and help traders make more informed decisions.

Using the Ethereum ETH Chart for Investment

Now that you have a better understanding of the Ethereum ETH chart and its various components, let’s explore how you can use it for investment purposes:

Identifying Entry and Exit Points

By analyzing the Ethereum ETH chart, you can identify potential entry and exit points for your investments. Look for patterns such as support and resistance levels, trend lines, and technical indicators to make informed decisions.

Setting Stop-Loss and Take-Profit Levels

Stop-loss and take-profit levels are essential risk management tools. By setting these levels based on the Ethereum ETH chart, you can protect your investments from significant losses and secure profits.

Long-Term vs. Short-Term Investments

The Ethereum ETH chart can help you determine whether you are more suited for long-term or short-term investments. Long-term investors may focus on identifying long-term trends and patterns, while short-term investors may pay more attention to short-term price movements and volatility.

Conclusion

The Ethereum ETH chart is a powerful tool for analyzing the price movements of Ethereum and making informed investment decisions. By understanding the various chart types, interpreting the chart correctly, and using it for investment purposes, you can increase your chances of success in the cryptocurrency market.