Do I Lose Money Exchanging ETH for Alt Coin?

When considering exchanging Ethereum (ETH) for an alternative cryptocurrency (alt coin), it’s natural to wonder about the potential financial implications. The crypto market is known for its volatility, and the decision to trade one digital asset for another can have various outcomes. Let’s delve into the factors that can influence whether you might lose money during this exchange process.

Understanding the Market Dynamics

The crypto market is influenced by numerous factors, including global economic conditions, regulatory news, technological advancements, and market sentiment. Before diving into the exchange, it’s crucial to understand these dynamics.

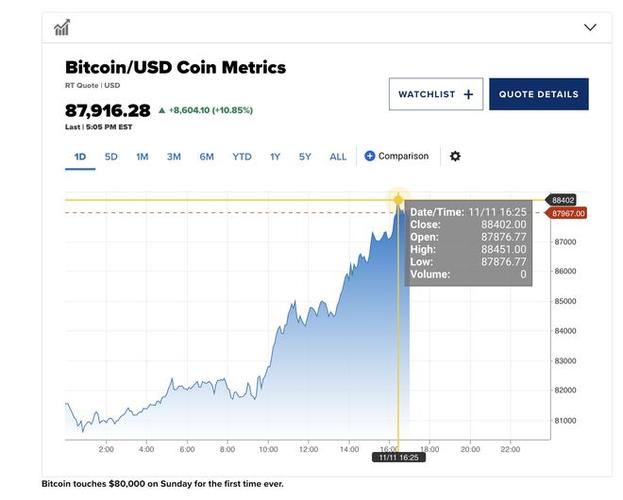

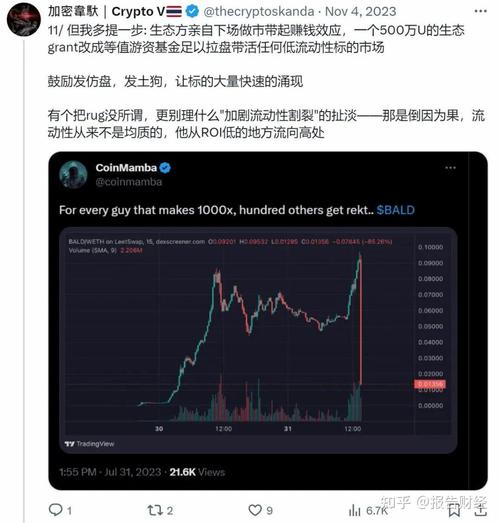

1. Market Volatility: The crypto market is highly volatile, with prices fluctuating rapidly. This volatility can lead to significant gains or losses in a short period.

2. Supply and Demand: The supply and demand for ETH and the alt coin you’re considering can impact the exchange rate. If the alt coin is in high demand, its value might increase, potentially leading to a profitable exchange.

3. Market Sentiment: The overall sentiment towards the crypto market can influence prices. Positive news can drive up prices, while negative news can lead to a decline.

Exchange Fees and Slippage

When exchanging ETH for an alt coin, you’ll encounter exchange fees and slippage, which can affect your overall profit or loss.

1. Exchange Fees: Most exchanges charge a fee for facilitating the trade. These fees can vary depending on the platform and the amount of the transaction.

2. Slippage: Slippage occurs when the price of the alt coin changes between the time you place the order and when it’s executed. This can happen due to high volatility or a large order size. Slippage can lead to a less favorable exchange rate, potentially resulting in a loss.

Choosing the Right Exchange

Selecting the right exchange is crucial to minimize fees and slippage. Here are some factors to consider:

1. Reputation: Choose a reputable exchange with a good track record of security and customer service.

2. Fees: Compare the fees charged by different exchanges to find the most cost-effective option.

3. Liquidity: Look for exchanges with high liquidity, as this can help reduce slippage.

Understanding the Alt Coin

Before exchanging ETH for an alt coin, it’s essential to research the alt coin thoroughly.

1. Market Cap: The market capitalization of the alt coin can indicate its size and stability. A higher market cap might suggest a more established and reliable asset.

2. Use Case: Understand the purpose and use case of the alt coin. A coin with a strong use case and real-world applications might have a higher chance of long-term success.

3. Team and Community: Research the team behind the alt coin and the strength of its community. A strong team and active community can contribute to the coin’s success.

Timing the Exchange

The timing of your exchange can significantly impact your profit or loss.

1. Market Trends: Keep an eye on market trends and news that could affect the prices of ETH and the alt coin you’re considering.

2. Historical Data: Analyze historical data to identify patterns and trends that might help you make a more informed decision.

3. Risk Management: Set a risk management strategy, such as setting a maximum loss threshold, to protect your investment.

Conclusion

Exchanging ETH for an alt coin can be a lucrative opportunity, but it also comes with risks. By understanding the market dynamics, choosing the right exchange, researching the alt coin, and timing your exchange wisely, you can minimize the chances of losing money. However, it’s important to remember that the crypto market is unpredictable, and there’s always a risk involved in trading digital assets.