Understanding the Value of 0.14 ETH

Have you ever wondered what 0.14 ETH is worth in today’s market? As the cryptocurrency world continues to evolve, understanding the value of different digital assets, like Ethereum (ETH), is crucial. In this detailed guide, we’ll explore the significance of 0.14 ETH, its historical price movements, factors influencing its value, prediction methods, and how to keep track of its real-time price.

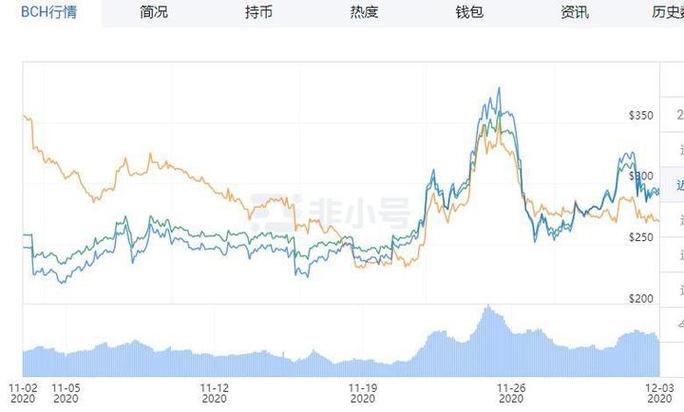

Historical Price Movements of ETH

Ethereum, the platform that introduced smart contracts and decentralized applications, has seen its native token, ETH, undergo significant price fluctuations since its inception. Initially launched on July 30, 2015, ETH started at a modest price of $0.31. Over the years, its value has experienced both rapid growth and sharp declines.

| Year | Starting Price | Ending Price | Change |

|---|---|---|---|

| 2015 | $0.31 | $2.80 | 8.97x |

| 2016 | $2.80 | $0.60 | -78.57% |

| 2017 | $8.00 | $730.00 | 9,125.00x |

| 2018 | $1,400.00 | $85.00 | -94.29% |

| 2019 | $130.00 | $130.00 | 0.00% |

| 2020 | $130.00 | $730.00 | 460.77% |

| 2021 | $730.00 | $6,000.00 | 824.14% |

Factors Influencing ETH Value

The value of ETH is influenced by a variety of factors, including market sentiment, technological advancements, regulatory news, and macroeconomic trends. Here are some key factors to consider:

-

Market Sentiment: The overall perception of the cryptocurrency market can greatly impact ETH’s value. Positive news, such as increased adoption or partnerships, can lead to a surge in price, while negative news, such as regulatory crackdowns or security breaches, can cause prices to plummet.

-

Technological Advancements: Ethereum’s ongoing development, such as the Ethereum 2.0 upgrade, can influence its value. As the network becomes more efficient and scalable, it may attract more users and developers, potentially increasing demand for ETH.

-

Regulatory News: The regulatory landscape for cryptocurrencies is constantly evolving. News regarding new regulations or changes in existing laws can have a significant impact on ETH’s value.

-

Macroeconomic Trends: Economic factors, such as inflation or changes in interest rates, can also influence ETH’s value. For example, during periods of economic uncertainty, investors may turn to cryptocurrencies as a safe haven, driving up demand and prices.

Prediction Methods for ETH

Predicting the future value of ETH is a challenging task, as it involves numerous variables and uncertainties. However, there are several methods that traders and investors use to make informed decisions:

-

Technical Analysis: This method involves analyzing historical price data and using various indicators to predict future price movements. Traders often look for patterns, trends, and support/resistance levels to make predictions.

-

Fundamental Analysis: This method involves evaluating the intrinsic value of ETH by analyzing factors such as network activity, developer activity, and market sentiment. Investors often look for signs of long-term growth potential.