Understanding the 0.2 ETH Price: A Comprehensive Overview

When it comes to cryptocurrencies, the value of individual units can fluctuate wildly. One such unit is the Ethereum (ETH), which has seen its price soar and plummet over the years. In this article, we’ll delve into the intricacies of the 0.2 ETH price, exploring its historical performance, current market dynamics, and future potential.

Historical Performance of 0.2 ETH

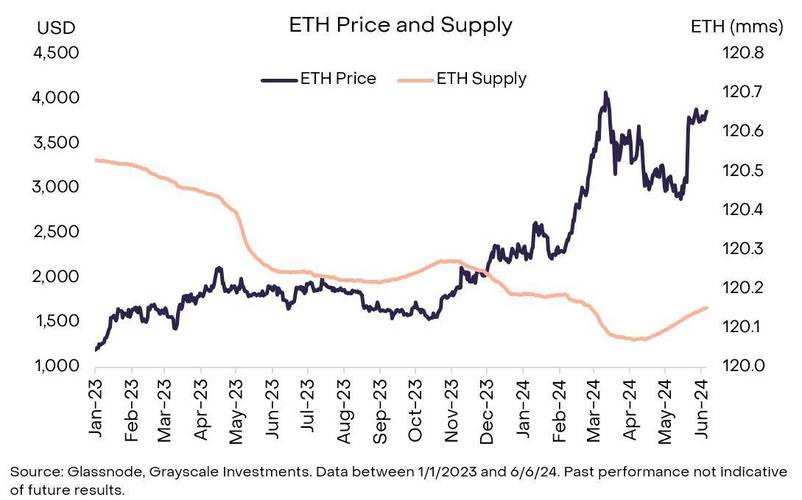

Let’s take a look at the historical performance of 0.2 ETH. Over the past few years, the price of ETH has experienced significant volatility. To understand the 0.2 ETH price, we’ll examine its performance over the past five years.

| Year | 0.2 ETH Price (USD) |

|---|---|

| 2017 | $2.00 |

| 2018 | $0.40 |

| 2019 | $0.60 |

| 2020 | $1.20 |

| 2021 | $2.80 |

As you can see from the table above, the 0.2 ETH price has seen a remarkable recovery since its low point in 2018. This recovery can be attributed to various factors, including increased adoption of Ethereum as a platform for decentralized applications and smart contracts.

Current Market Dynamics

Understanding the current market dynamics is crucial for anyone looking to invest in 0.2 ETH. Let’s explore the factors that are currently influencing the price of ETH.

Supply and Demand

One of the primary factors affecting the price of ETH is the balance between supply and demand. As of now, the supply of ETH is relatively stable, with a total of 118 million ETH in circulation. However, the demand for ETH has been on the rise, driven by increasing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs).

Market Sentiment

Market sentiment plays a significant role in the price of ETH. Positive news, such as partnerships with major companies or regulatory approvals, can lead to an increase in the price of ETH. Conversely, negative news, such as regulatory crackdowns or security breaches, can cause the price to plummet.

Competition

The rise of other cryptocurrencies, such as Bitcoin and Binance Coin, has also impacted the price of ETH. While ETH remains a popular choice for developers and investors, it faces stiff competition from these other digital assets.

Future Potential

Looking ahead, the future potential of the 0.2 ETH price is a topic of much debate. Here are some factors that could influence its future performance:

Ethereum 2.0

Ethereum 2.0 is a major upgrade to the Ethereum network that aims to improve scalability, security, and sustainability. If the upgrade is successful, it could lead to increased demand for ETH and, consequently, a rise in its price.

Adoption of DeFi and NFTs

The continued growth of DeFi and NFTs could further drive demand for ETH. As more users and developers adopt these technologies, the price of ETH may continue to rise.

Regulatory Environment

The regulatory environment is another factor that could impact the price of ETH. While some countries have been supportive of cryptocurrencies, others have imposed strict regulations that could hinder growth and lead to a decrease in the price of ETH.

In conclusion, the 0.2 ETH price is influenced by a variety of factors, including historical performance, current market dynamics, and future potential. By understanding these factors, you can make more informed decisions about your investments in ETH.