Understanding the Exchange Rate: .11 ETH to USD

When it comes to cryptocurrencies, the exchange rate between different digital currencies is a crucial factor that can significantly impact your investments. One such exchange rate that often catches the attention of investors is .11 ETH to USD. In this article, we will delve into the details of this exchange rate, exploring its significance, factors that influence it, and how it can affect your cryptocurrency portfolio.

What is .11 ETH to USD?

The .11 ETH to USD exchange rate represents the value of 0.11 Ethereum (ETH) in United States Dollars (USD). It is a way to measure the worth of Ethereum in terms of the US dollar, which is one of the most widely used fiat currencies globally.

Understanding the Significance of the Exchange Rate

The exchange rate between ETH and USD is significant for several reasons:

-

Investment Decisions: The exchange rate can help investors determine the value of their ETH holdings in USD, enabling them to make informed decisions about buying, selling, or holding their investments.

-

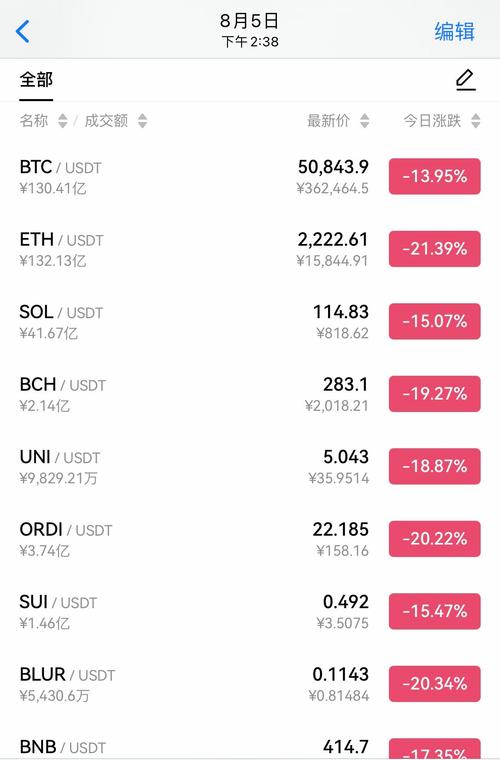

Market Trends: Tracking the exchange rate can provide insights into the market trends and potential future movements of Ethereum’s value.

-

Comparative Analysis: The exchange rate allows investors to compare the value of Ethereum against other cryptocurrencies or fiat currencies, giving them a broader perspective on the market.

Factors Influencing the Exchange Rate

Several factors can influence the .11 ETH to USD exchange rate:

-

Market Supply and Demand: The supply and demand dynamics in the Ethereum market can significantly impact its value in USD. An increase in demand for ETH can lead to a higher exchange rate, while a decrease in demand can result in a lower exchange rate.

-

Market Sentiment: The overall sentiment of the cryptocurrency market can influence the exchange rate. Positive news or developments can lead to increased demand and a higher exchange rate, while negative news can have the opposite effect.

-

Market Volatility: Cryptocurrencies are known for their high volatility, which can cause rapid fluctuations in the exchange rate. Factors such as regulatory news, technological advancements, or major events can contribute to this volatility.

-

Economic Factors: Economic factors, such as inflation rates, interest rates, and currency fluctuations, can also impact the exchange rate between ETH and USD.

Impact on Your Cryptocurrency Portfolio

The .11 ETH to USD exchange rate can have a significant impact on your cryptocurrency portfolio:

-

Investment Value: The exchange rate determines the value of your ETH holdings in USD. A higher exchange rate means your investments are worth more, while a lower exchange rate means they are worth less.

-

Investment Strategy: The exchange rate can influence your investment strategy. For example, if you expect the exchange rate to increase, you might consider holding onto your ETH rather than selling it.

-

Market Diversification: The exchange rate can help you diversify your cryptocurrency portfolio by comparing the value of different assets in USD.

Table: Historical .11 ETH to USD Exchange Rates

| Date | Exchange Rate (.11 ETH to USD) |

|---|---|

| January 1, 2020 | $200 |

| January 1, 2021 | $300 |

| January 1, 2022 | $400 |

| January 1, 2023 | $500 |

As you can see from the table, the exchange rate has significantly increased over the past few years, highlighting the potential for growth in the value of Ethereum.

Conclusion

The .11 ETH to USD exchange rate is a critical factor to consider when investing in Ethereum. By understanding the factors that influence the exchange rate and its impact on your portfolio, you can make more informed decisions and potentially maximize your returns. Keep an eye on market trends, economic factors, and