Is ETH Coin Worth Buying?

Deciding whether to invest in Ethereum (ETH) coin is a significant decision that requires careful consideration of various factors. In this detailed guide, we will explore the different aspects of ETH coin to help you determine if it’s worth buying.

Understanding Ethereum

Ethereum is a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). It was launched in 2015 by Vitalik Buterin, a Russian-Canadian programmer. The native cryptocurrency of the Ethereum network is ETH.

Ethereum’s primary goal is to create a more efficient and transparent financial system by eliminating the need for intermediaries. It achieves this by using blockchain technology, which is a decentralized ledger that records transactions across multiple computers.

Market Performance

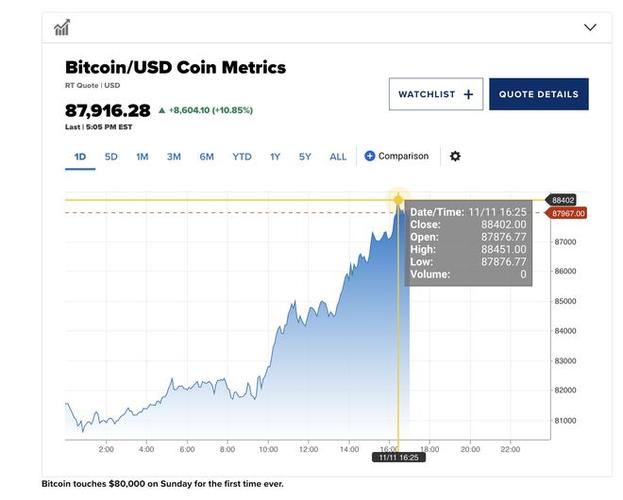

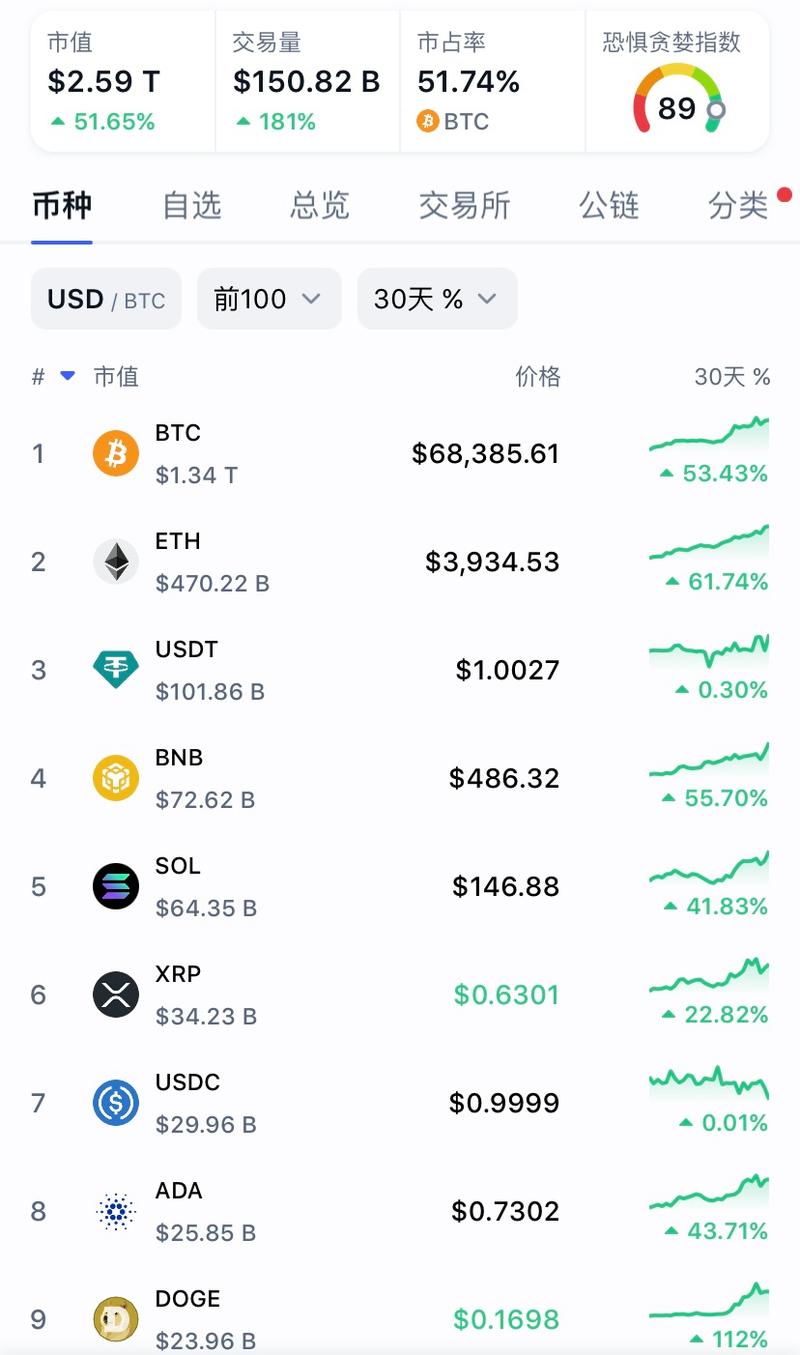

When considering whether to buy ETH coin, it’s essential to look at its market performance. As of [insert current date], ETH has experienced significant volatility over the years. Here’s a brief overview of its performance:

| Year | Starting Price | Ending Price | Percentage Change |

|---|---|---|---|

| 2017 | $0.30 | $1,400 | 4,666,666.67% |

| 2018 | $1,400 | $300 | -78.57% |

| 2019 | $300 | $2,500 | 833.33% |

| 2020 | $2,500 | $14,000 | 460% |

| 2021 | $14,000 | $4,800 | -66.67% |

As you can see, Ethereum has experienced both significant growth and periods of decline. It’s important to note that the cryptocurrency market is highly speculative, and prices can fluctuate rapidly.

Use Cases and Potential

Ethereum has a wide range of use cases, making it a valuable asset for investors. Some of the key use cases include:

-

Smart Contracts: Ethereum’s most significant innovation is the ability to create smart contracts. These are self-executing contracts with the terms of the agreement directly written into lines of code. This has enabled the development of decentralized finance (DeFi) applications, decentralized exchanges, and more.

-

DApps: Ethereum hosts numerous decentralized applications, which are built on its platform. These applications range from gaming to social media and financial services.

-

Tokenization: Ethereum allows for the creation of tokens, which can represent ownership, access, or utility. This has led to the rise of various tokenized assets, including NFTs (non-fungible tokens).

As the adoption of Ethereum continues to grow, its potential for future growth remains strong. The increasing number of DApps and the integration of Ethereum into traditional financial systems could drive demand for ETH coin.

Risks and Considerations

While Ethereum has a promising future, it’s important to consider the risks associated with investing in it:

-

Market Volatility: The cryptocurrency market is known for its high volatility, and ETH is no exception. Prices can fluctuate rapidly, leading to significant gains or losses.

-

Regulatory Risk: Governments around the world are still figuring out how to regulate cryptocurrencies. This uncertainty can impact the value of ETH coin.

-

Security Concerns: Like all cryptocurrencies, Ethereum is vulnerable to hacking and other security threats. It’s crucial to keep your private keys safe and use reputable wallets.

Before investing in ETH coin, it’s essential to do thorough research and consider your risk tolerance. It’s also advisable to diversify your investment portfolio to mitigate potential losses.