Eth DeFi Staking: A Comprehensive Guide for You

Staking has emerged as a popular way to earn returns on your Ethereum (ETH) holdings. In this article, we delve into the world of Ethereum DeFi staking, exploring its benefits, risks, and how it works. Whether you’re a seasoned crypto investor or just starting out, this guide will provide you with the knowledge you need to make informed decisions.

What is Ethereum DeFi Staking?

Ethereum DeFi staking refers to the process of locking up your ETH tokens to support the Ethereum network and earn rewards in return. By participating in staking, you help secure the network and ensure its smooth operation. In return, you receive staking rewards, which are distributed based on the amount of ETH you have staked and the duration of your participation.

How Does Ethereum DeFi Staking Work?

Ethereum DeFi staking is facilitated by the Ethereum 2.0 upgrade, which aims to transition the network from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism. Here’s a simplified explanation of how it works:

-

Participants lock up a certain amount of ETH to become validators.

-

Validators are responsible for validating transactions and adding new blocks to the Ethereum blockchain.

-

Validators are chosen to create new blocks based on their staked ETH and the randomness of the selection process.

-

When a validator successfully adds a new block, they receive staking rewards.

It’s important to note that not all Ethereum DeFi staking platforms are the same. Some platforms may offer different rewards, terms, and conditions. Be sure to research and choose a platform that aligns with your investment goals and risk tolerance.

Benefits of Ethereum DeFi Staking

Staking your ETH tokens offers several benefits, including:

-

Earn rewards: Staking allows you to earn rewards in the form of ETH tokens. These rewards can be a significant source of income, especially if you have a large amount of ETH.

-

Support the Ethereum network: By participating in staking, you contribute to the security and stability of the Ethereum network. This can lead to long-term benefits for the entire ecosystem.

-

Access to exclusive features: Some staking platforms offer additional features, such as governance rights or access to new DeFi projects.

Risks of Ethereum DeFi Staking

While Ethereum DeFi staking offers numerous benefits, it’s important to be aware of the risks involved:

-

Lock-up period: Once you lock up your ETH tokens for staking, you won’t be able to access them until the lock-up period ends. This can be a significant concern if you need to liquidate your assets quickly.

-

Reward volatility: Staking rewards can be subject to volatility, depending on the market conditions and the performance of the Ethereum network.

-

Platform-specific risks: Different staking platforms may have varying levels of risk, including security vulnerabilities, regulatory issues, and platform-specific risks.

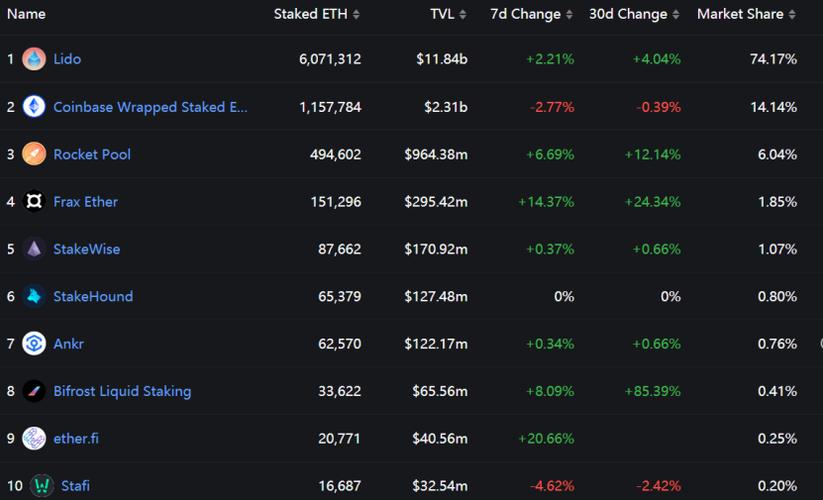

Top Ethereum DeFi Staking Platforms

Here are some of the top Ethereum DeFi staking platforms you can consider:

| Platform | Minimum Stake | Reward Rate | Lock-up Period |

|---|---|---|---|

| MyEtherWallet (MEW) | 32 ETH | 4.5% – 5.5% | 6 months |

| Staked | 32 ETH | 4.5% – 5.5% | 6 months |

| Infinito | 32 ETH | 4.5% – 5.5% | 6 months |

| MetaMask |