Understanding the Eth Deflationary Chart: A Detailed Overview

When it comes to Ethereum, one of the most fascinating aspects is its deflationary nature. The Ethereum deflationary chart is a visual representation of this unique characteristic, and in this article, we will delve into the details of what it entails, how it works, and its implications for the Ethereum ecosystem.

What is Deflation?

Deflation is a term used in economics to describe a situation where the general price level of goods and services falls over time. In the context of cryptocurrencies, deflation refers to a decrease in the total supply of a digital asset, which can lead to an increase in its value over time.

The Ethereum Deflationary Mechanism

Ethereum’s deflationary mechanism is primarily driven by its mining rewards structure. Unlike Bitcoin, which has a fixed supply cap, Ethereum’s supply is not capped. Instead, it is designed to decrease over time as a result of the network’s mining rewards becoming less attractive.

Here’s how it works:

-

When Ethereum was first launched, miners were rewarded with both new ETH tokens and transaction fees.

-

As the network grew, the block reward for mining new blocks was halved approximately every four years, starting with the first halving in 2016.

-

This halving process is expected to continue until the block reward reaches zero, which is projected to happen around the year 2140.

As a result of this halving process, the total supply of ETH is expected to decrease over time, leading to a deflationary environment.

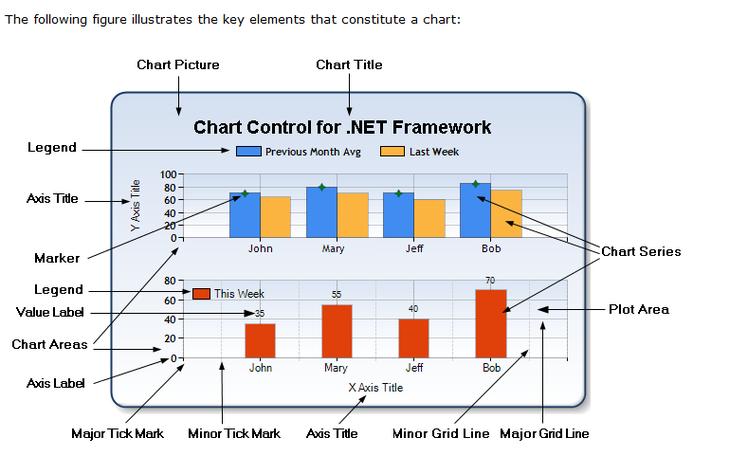

The Ethereum Deflationary Chart

The Ethereum deflationary chart is a visual representation of the decreasing supply of ETH over time. It typically shows the total supply of ETH on the x-axis and the time period on the y-axis. The chart can be divided into several key components:

-

Initial Supply: This is the total supply of ETH at the time of its launch.

-

Current Supply: This is the total supply of ETH at the current time.

-

Projected Supply: This is the estimated total supply of ETH at a future point in time, based on the current halving schedule.

Here’s an example of what an Ethereum deflationary chart might look like: