Understanding the Eth Coin Chart: A Comprehensive Guide

When diving into the world of cryptocurrencies, the Ethereum (ETH) coin chart is a vital tool for both beginners and seasoned investors. It provides a visual representation of the price movements, market capitalization, trading volume, and other key metrics of ETH. In this detailed guide, we will explore the various aspects of the ETH coin chart, helping you make informed decisions in your cryptocurrency investments.

Price Movements

The price of ETH is constantly changing, influenced by a multitude of factors such as market sentiment, supply and demand, and regulatory news. The ETH coin chart displays the historical price data, allowing you to analyze trends and patterns. By examining the chart, you can identify periods of growth, decline, and consolidation.

For instance, the chart may show a steady upward trend over the past few months, indicating a strong demand for ETH. Conversely, a downward trend might suggest a bearish market sentiment or negative news affecting the cryptocurrency. It’s crucial to understand these trends to make well-informed investment decisions.

Market Capitalization

Market capitalization is a measure of the total value of a cryptocurrency’s circulating supply. The ETH coin chart includes the market capitalization data, which can help you assess the overall size and stability of the Ethereum network. A higher market capitalization generally indicates a more established and trusted cryptocurrency.

By comparing the market capitalization of ETH with other cryptocurrencies, you can gauge its position in the market. For example, if ETH has a higher market capitalization than Bitcoin, it suggests that ETH is currently more popular among investors. However, it’s important to consider other factors such as trading volume and liquidity before making investment decisions.

Trading Volume

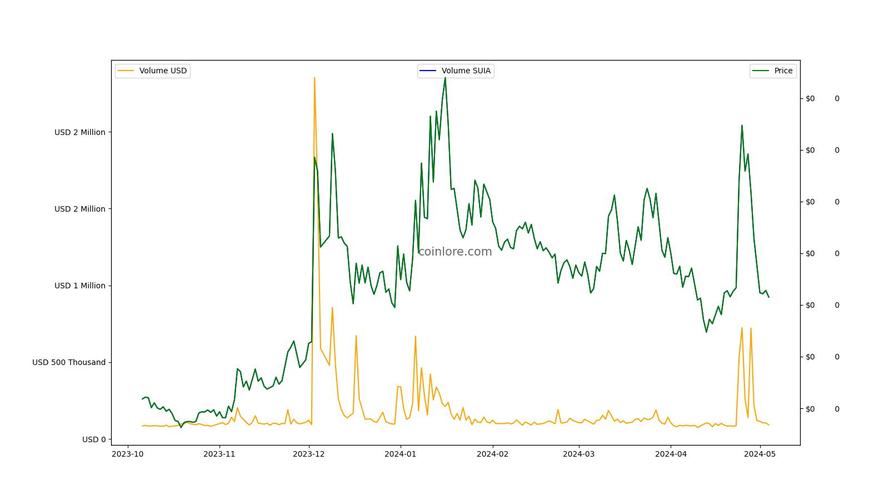

Trading volume is a measure of the total number of ETH coins being bought and sold within a specific time frame. The ETH coin chart displays the trading volume data, which can provide insights into the market’s activity and liquidity. A high trading volume often indicates strong interest in the cryptocurrency, while a low trading volume might suggest a lack of investor interest.

By analyzing the trading volume, you can identify periods of high activity and potential price movements. For instance, a sudden surge in trading volume might indicate a significant price increase, while a decrease in trading volume might suggest a lack of investor confidence. It’s essential to consider trading volume in conjunction with other factors to make well-informed investment decisions.

Historical Price Data

The ETH coin chart includes historical price data, allowing you to analyze past trends and patterns. By examining the chart, you can identify support and resistance levels, which are critical price points where the market has historically shown buying or selling pressure.

Support levels are price points where the market has repeatedly shown buying pressure, preventing the price from falling further. Resistance levels, on the other hand, are price points where the market has shown selling pressure, preventing the price from rising further. By identifying these levels, you can make more informed decisions about entering or exiting the market.

Technical Indicators

Technical indicators are tools used to analyze price movements and predict future trends. The ETH coin chart often includes various technical indicators, such as moving averages, relative strength index (RSI), and Bollinger Bands. These indicators can help you identify potential buy and sell signals, as well as overbought or oversold conditions.

For example, a moving average crossover can indicate a potential trend reversal, while an RSI reading above 70 might suggest an overbought condition. By understanding and utilizing these technical indicators, you can gain valuable insights into the market and make more informed investment decisions.

Conclusion

Understanding the ETH coin chart is essential for anyone interested in investing in Ethereum. By analyzing price movements, market capitalization, trading volume, historical price data, and technical indicators, you can gain valuable insights into the market and make well-informed investment decisions. Remember to consider various factors and conduct thorough research before making any investment decisions.

| Technical Indicator | Description |

|---|---|

| Simple Moving Average (SMA) | Calculates the average price of a cryptocurrency over a specified time period. |

| Exponential Moving Average (EMA) | Similar to SMA, but gives more weight to recent price data. |

| Relative Strength Index (RSI) | Measures the speed and

相关文章Like |