Understanding ETH 2.0: A Deep Dive into 32 ETH Investment

Investing in Ethereum 2.0, the highly anticipated upgrade to the Ethereum network, can be a game-changer for cryptocurrency enthusiasts. With the potential for significant returns, understanding the intricacies of this investment is crucial. Let’s delve into what ETH 2.0 is, its benefits, risks, and how a 32 ETH investment could shape your financial future.

What is Ethereum 2.0?

Ethereum 2.0, also known as Eth2, is a major upgrade to the Ethereum network. It aims to address some of the limitations of the current system, such as scalability and energy consumption. The upgrade involves shifting from a Proof of Work (PoW) consensus mechanism to a Proof of Stake (PoS) mechanism, which is expected to make the network more energy-efficient and scalable.

The Benefits of Ethereum 2.0

One of the primary benefits of Ethereum 2.0 is its potential to significantly improve the network’s scalability. By transitioning to PoS, the network can handle more transactions per second, making it more suitable for decentralized applications (dApps) and smart contracts. This scalability is crucial for the long-term success of Ethereum as a platform for decentralized finance (DeFi) and other innovative projects.

Another significant advantage of Eth2 is its energy efficiency. The PoW mechanism used by Ethereum currently consumes a considerable amount of electricity, which has raised concerns about its environmental impact. By adopting PoS, Ethereum 2.0 aims to reduce its energy consumption by a significant margin, making it a more sustainable option.

The Risks of Investing in ETH 2.0

While investing in ETH 2.0 offers numerous benefits, it’s essential to be aware of the risks involved. One of the main risks is the uncertainty surrounding the upgrade’s timeline. Ethereum 2.0 has faced several delays, and there’s no guarantee that the upgrade will be completed as planned. This uncertainty can lead to volatility in the price of ETH, making it a risky investment for those not prepared to handle potential losses.

Another risk is the potential for technical issues. The transition to PoS is a complex process, and there’s always a chance that something could go wrong. This could lead to further delays or even a complete failure of the upgrade, negatively impacting the value of ETH.

Understanding the 32 ETH Investment

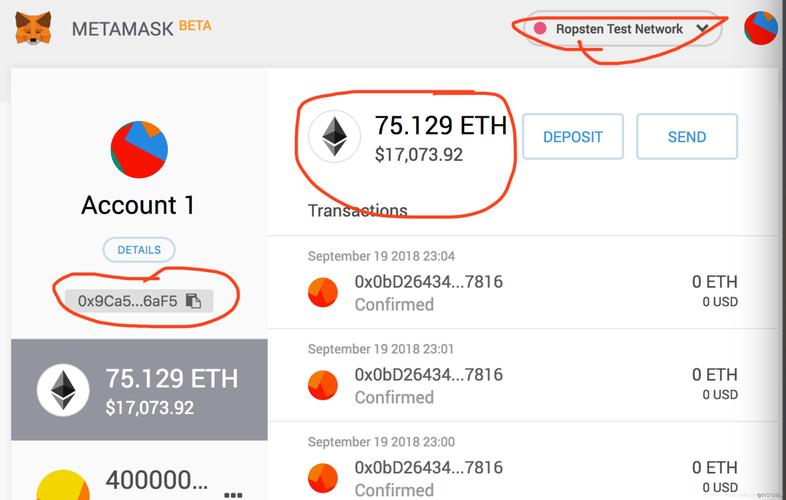

Now that we have a better understanding of Ethereum 2.0, let’s explore what a 32 ETH investment could mean for you. At the time of writing, the price of ETH is fluctuating, but for the sake of this example, let’s assume a price of $2,000 per ETH. This would mean an investment of $64,000 in ETH.

One of the main benefits of a 32 ETH investment is the potential for staking rewards. In the PoS system, validators who lock up their ETH can earn rewards for participating in the network’s consensus process. The exact amount of rewards will depend on various factors, including the total amount of ETH staked and the network’s performance.

However, it’s important to note that staking rewards are not guaranteed. The rewards are distributed based on the network’s performance, and there’s always a chance that the rewards could be lower than expected. Additionally, the rewards are subject to taxation, depending on your jurisdiction.

Conclusion

Investing in ETH 2.0, with a 32 ETH investment, can be a lucrative opportunity, but it’s not without risks. Understanding the benefits and risks of the upgrade, as well as the potential rewards of staking, is crucial for making an informed decision. As with any investment, it’s essential to do your research and consider your risk tolerance before diving in.

| Investment Amount | ETH Price | Total Investment |

|---|---|---|

| 32 ETH | $2,000 | $64,000 |

Remember, the cryptocurrency market is highly volatile, and the value of your investment can fluctuate significantly. Always invest responsibly and consult with a financial advisor if you’re unsure about the best course of action.