Understanding ETH 10 Range Trading Chart: A Detailed Guide for You

When it comes to trading Ethereum, one of the most crucial tools at your disposal is the 10 range trading chart. This chart provides a comprehensive view of Ethereum’s price movements over a 10-day period, allowing you to make informed decisions. In this article, we will delve into the intricacies of the ETH 10 range trading chart, helping you understand its various aspects and how to utilize it effectively.

What is an ETH 10 Range Trading Chart?

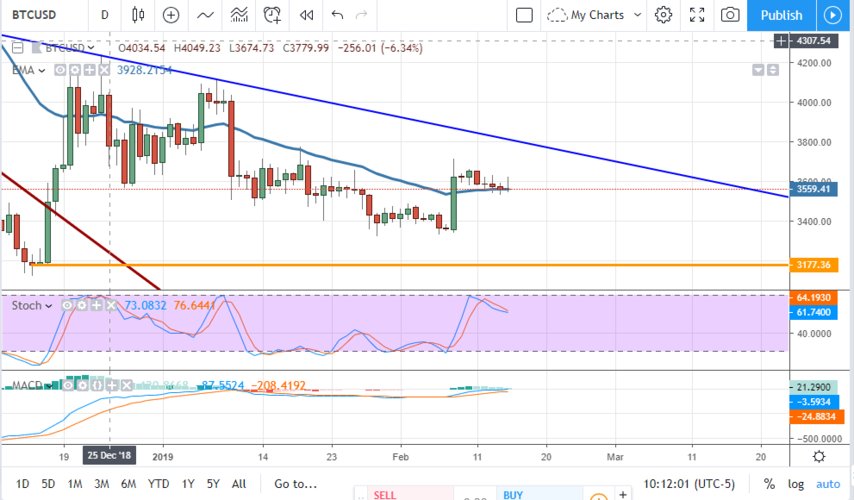

An ETH 10 range trading chart is a visual representation of Ethereum’s price movements over a 10-day period. It displays the opening, closing, highest, and lowest prices of Ethereum during this time frame. By analyzing this chart, you can gain insights into the market’s trends, identify potential entry and exit points, and make more informed trading decisions.

Understanding the Components of the ETH 10 Range Trading Chart

The ETH 10 range trading chart consists of several key components that you need to be familiar with:

| Component | Description |

|---|---|

| Opening Price | The price at which Ethereum opened on the first day of the 10-day period. |

| Closing Price | The price at which Ethereum closed on the last day of the 10-day period. |

| High Price | The highest price reached by Ethereum during the 10-day period. |

| Low Price | The lowest price reached by Ethereum during the 10-day period. |

These components are essential for understanding the price movements of Ethereum over the specified time frame.

Interpreting the ETH 10 Range Trading Chart

Interpreting the ETH 10 range trading chart involves analyzing various aspects, such as trends, support and resistance levels, and candlestick patterns. Let’s explore these aspects in detail:

Trends

Trends are one of the most critical aspects of the ETH 10 range trading chart. They can be classified into three types: uptrend, downtrend, and sideways trend.

- Uptrend: Characterized by higher highs and higher lows, an uptrend indicates that Ethereum is gaining momentum and is likely to continue rising.

- Downtrend: Marked by lower highs and lower lows, a downtrend suggests that Ethereum is losing momentum and may continue to fall.

- Sideways Trend: Characterized by roughly equal highs and lows, a sideways trend indicates that Ethereum is in a state of consolidation, with no clear direction.

Support and Resistance Levels

Support and resistance levels are critical price points that indicate where the market is likely to reverse its direction. These levels can be identified by observing the chart and looking for areas where the price has repeatedly failed to break through.

- Support Level: A price level where the market has repeatedly found support and is likely to bounce back.

- Resistance Level: A price level where the market has repeatedly faced resistance and is likely to reverse its direction.

Candlestick Patterns

Candlestick patterns are visual representations of price movements that can provide valuable insights into market sentiment. Some common candlestick patterns include:

- Bullish Engulfing: A bullish reversal pattern where a long white candlestick engulfs a previous bearish candlestick.

- Doji: A pattern where the opening and closing prices are nearly equal, indicating uncertainty in the market.

- Hammer: A bullish reversal pattern where a small body is located at the bottom of a long lower shadow, suggesting a potential upside reversal.

Utilizing the ETH 10 Range Trading Chart for Trading

Now that you understand the various aspects of the ETH 10 range trading chart, let’s explore how to use it for trading:

- Identify Trends: Determine whether Ethereum is in an uptrend, downt