Eth Destroying Coins: A Comprehensive Overview

Have you ever wondered what happens to the coins that are destroyed in the Ethereum network? The concept of destroying coins is a unique aspect of Ethereum’s economic model, and it has significant implications for the network’s overall health and value. In this article, we will delve into the various dimensions of coin destruction in Ethereum, exploring its purpose, mechanisms, and impact on the network.

Understanding Coin Destruction

At its core, coin destruction in Ethereum refers to the process of permanently removing coins from circulation. This is achieved through a mechanism called “burning,” where coins are sent to a special address that cannot be accessed or transacted with. The act of destroying coins is a deliberate strategy employed by Ethereum to manage its supply and maintain its value over time.

One of the primary reasons for coin destruction is to combat inflation. As Ethereum’s network grows, the supply of ETH increases, which can lead to a decrease in its value. By destroying coins, the supply is effectively reduced, which can help to stabilize or even increase the value of the remaining coins.

How Coins Are Destroyed

There are several ways in which coins can be destroyed in the Ethereum network:

-

Transaction Fees: One of the most common ways coins are destroyed is through transaction fees. When users make transactions on the Ethereum network, they pay a fee in ETH. A portion of these fees is burned, effectively reducing the supply of ETH.

-

Smart Contract Operations: Certain smart contracts are designed to destroy coins as part of their functionality. For example, a decentralized exchange might burn coins when a trade is executed, reducing the overall supply of the involved assets.

-

Token Burn Events: Some ERC-20 tokens have built-in mechanisms that allow for token burning. This can be done by the token’s developers or by token holders who vote to burn a certain amount of tokens.

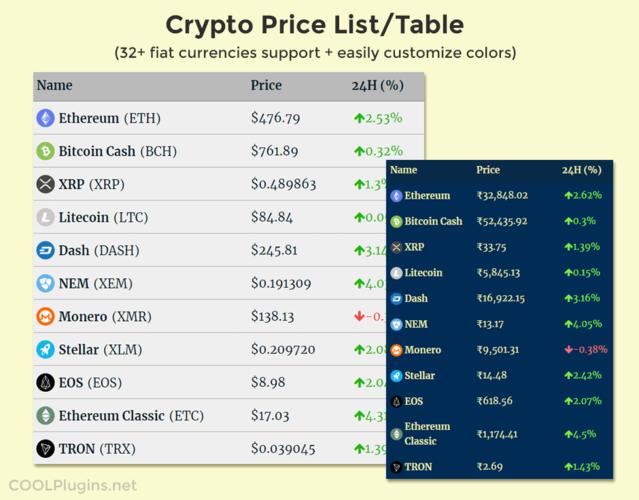

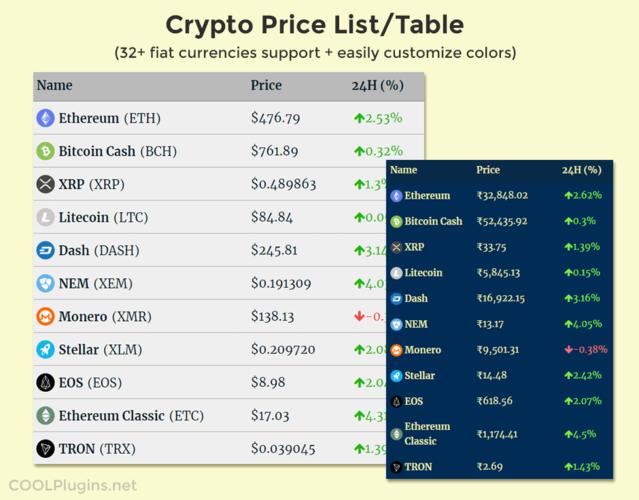

Here is a table summarizing the different methods of coin destruction:

| Method | Description |

|---|---|

| Transaction Fees | Coins are burned as part of the transaction fee process. |

| Smart Contract Operations | Coins are burned during specific smart contract operations. |

| Token Burn Events | Coins are burned through deliberate actions by token holders or developers. |

The Impact of Coin Destruction

The act of destroying coins has several implications for the Ethereum network:

-

Supply Reduction: By reducing the supply of ETH, coin destruction can help to stabilize or increase its value over time.

-

Network Security: A smaller supply of coins can make the network more secure, as there are fewer coins available for potential attackers to control.

-

Token Value: For ERC-20 tokens, coin destruction can increase the value of the remaining tokens, as there are fewer coins in circulation.

However, it’s important to note that coin destruction is not without its drawbacks. For example, it can lead to a decrease in liquidity, as fewer coins are available for trading. Additionally, the process of coin destruction can be complex and may require careful consideration to ensure that it is implemented effectively.

Conclusion

In conclusion, coin destruction is a unique and important aspect of the Ethereum network. By understanding the purpose, mechanisms, and impact of coin destruction, we can gain a better appreciation for the strategies employed by Ethereum to manage its supply and maintain its value. As the network continues to evolve, it will be interesting to see how coin destruction continues to play a role in shaping its future.