Eth 200 Day Moving Average Chart: A Comprehensive Guide

Understanding the Ethereum 200-day moving average chart is crucial for any investor or trader looking to make informed decisions in the cryptocurrency market. This article delves into the intricacies of this chart, providing you with a detailed, multi-dimensional overview.

What is the 200-day Moving Average?

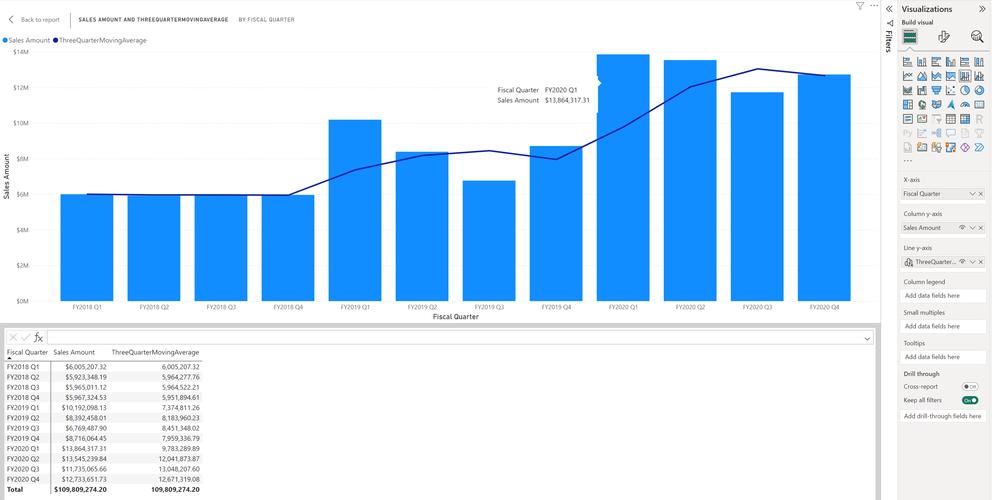

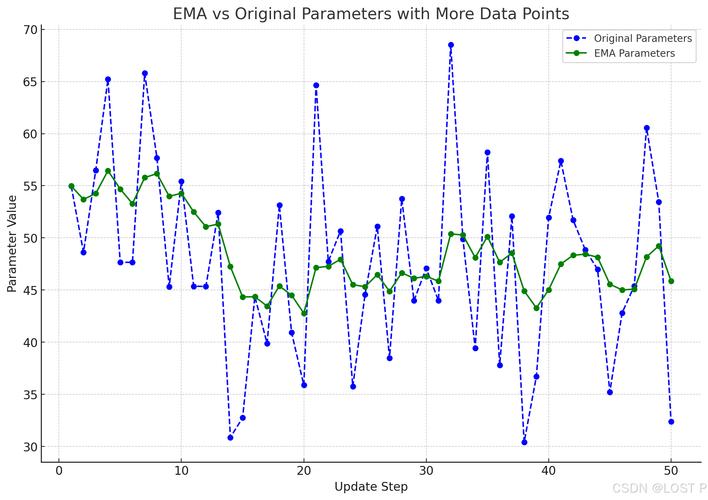

The 200-day moving average (DMA) is a widely used technical indicator in the financial markets. It calculates the average price of a security over a period of 200 days. This indicator is popular because it smooths out short-term price fluctuations, giving investors a clearer picture of the long-term trend.

Why is the 200-day Moving Average Important for Ethereum?

Ethereum, being one of the largest cryptocurrencies by market capitalization, has a significant following among investors. The 200-day moving average for Ethereum serves as a critical benchmark for many traders and investors. It helps them determine whether the current price is overvalued or undervalued and provides insights into the overall market sentiment.

How to Read the 200-day Moving Average Chart

Reading the 200-day moving average chart involves several key components:

-

Price Line: This is the line that represents the average price of Ethereum over the past 200 days.

-

Support and Resistance: These are price levels where the market has repeatedly shown buying or selling interest. The 200-day moving average can act as both support and resistance.

-

Crossovers: When the price line crosses above or below the 200-day moving average, it can indicate a potential trend reversal.

Interpreting the 200-day Moving Average Chart

Interpreting the 200-day moving average chart requires a keen eye and a solid understanding of technical analysis. Here are some key observations:

-

Price Above the 200-day Moving Average: This indicates that Ethereum is in an uptrend. Traders often look for buying opportunities when the price pulls back to the 200-day moving average.

-

Price Below the 200-day Moving Average: This suggests that Ethereum is in a downtrend. Traders may look for selling opportunities when the price approaches the 200-day moving average.

-

Crossovers: A bullish crossover occurs when the price line crosses above the 200-day moving average, indicating a potential trend reversal. Conversely, a bearish crossover occurs when the price line crosses below the 200-day moving average.

Using the 200-day Moving Average in conjunction with Other Indicators

The 200-day moving average is just one of many tools available to traders and investors. Combining it with other indicators can provide a more comprehensive view of the market. Here are a few popular indicators to consider:

-

Relative Strength Index (RSI): This indicator measures the speed and change of price movements. It can help identify overbought or oversold conditions.

-

Bollinger Bands: These bands provide a range of prices based on the 200-day moving average. They can help identify potential support and resistance levels.

-

Volume: Analyzing trading volume can provide insights into the strength of a trend.

Real-World Examples

Let’s take a look at a few real-world examples of how the 200-day moving average chart has been used in the past:

| Date | Ethereum Price | 200-day Moving Average | Market Sentiment |

|---|---|---|---|

| January 1, 2020 | $730 | $600 | Bullish |

| June 1, 2020 | $250 | $200 | Bearish |

| December 1, 2020 | $700 | $600 | Bullish |

In the