Understanding the ETH 2.0 Staking Percentage: A Comprehensive Guide

Staking has emerged as a pivotal aspect of Ethereum’s transition to its next iteration, Ethereum 2.0. As you delve into the world of decentralized finance and blockchain technology, understanding the staking percentage in ETH 2.0 becomes crucial. This article aims to provide you with a detailed, multi-dimensional introduction to the ETH 2.0 staking percentage, ensuring you have a comprehensive grasp of this critical concept.

What is ETH 2.0 Staking Percentage?

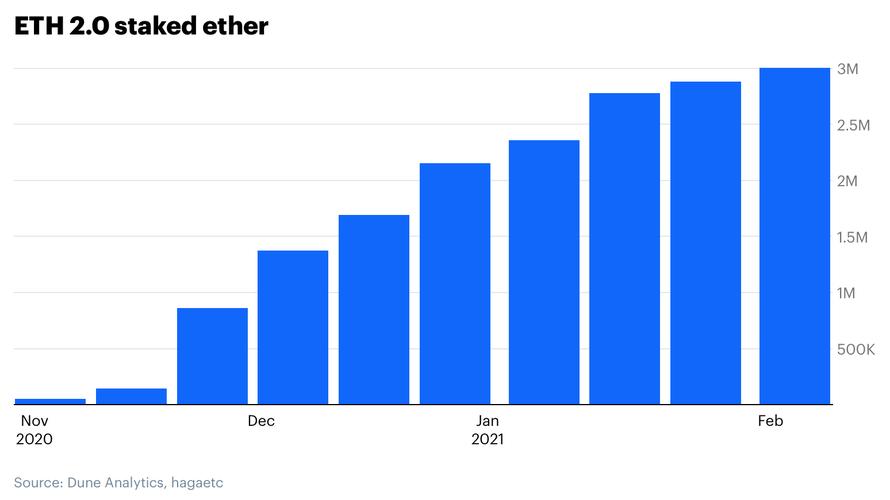

The ETH 2.0 staking percentage refers to the proportion of Ethereum’s total supply that is being actively staked by validators. Staking is a process where you lock up your ETH to participate in the Ethereum network’s consensus mechanism, securing the network and earning rewards in return.

Why is the Staking Percentage Important?

The staking percentage is a key indicator of the network’s health and participation. A higher staking percentage suggests a more robust and secure network, as more validators are actively participating in the consensus process. Conversely, a lower staking percentage may indicate a lack of participation or potential network vulnerabilities.

How is the Staking Percentage Calculated?

The staking percentage is calculated by dividing the total amount of ETH staked by the total supply of ETH. This percentage can fluctuate over time as more or fewer validators join or leave the network.

| Total ETH Staked | Total ETH Supply | Staking Percentage |

|---|---|---|

| 15,000,000 ETH | 120,000,000 ETH | 12.5% |

| 18,000,000 ETH | 120,000,000 ETH | 15% |

Factors Influencing the Staking Percentage

Several factors can influence the ETH 2.0 staking percentage:

-

Network Incentives: The rewards for staking ETH can incentivize more validators to join the network, increasing the staking percentage.

-

Validator Requirements: The requirements to become a validator, such as the minimum amount of ETH needed, can affect the staking percentage.

-

Network Security: A more secure network can attract more validators, leading to a higher staking percentage.

-

Market Conditions: The price of ETH can influence the staking percentage, as higher prices may incentivize more validators to join the network.

Benefits of Staking ETH 2.0

Staking ETH 2.0 offers several benefits:

-

Rewards: Stakers earn rewards in ETH for participating in the network’s consensus process.

-

Network Security: Staking helps secure the Ethereum network, ensuring its long-term viability.

-

Participation: Staking allows you to actively participate in the Ethereum ecosystem and contribute to its growth.

Risks of Staking ETH 2.0

While staking ETH 2.0 offers numerous benefits, it also comes with risks:

-

Lock-up Period: Staked ETH is locked up for a minimum of 6 months, during which you cannot withdraw your funds.

-

Reward Volatility: The rewards you earn from staking can be subject to market volatility.

-

Network Vulnerabilities: Staking ETH in a vulnerable network can expose you to potential losses.

Conclusion

Understanding the ETH 2.0 staking percentage is essential for anyone interested in participating in the Ethereum ecosystem. By analyzing the staking percentage, you can gain insights into the network’s health, participation, and potential rewards. As you consider staking ETH 2.0, weigh the benefits and risks to make an informed decision.