Eth Price: Coin Market Cap – A Comprehensive Overview

Understanding the value of Ethereum (ETH) and its market capitalization is crucial for anyone interested in the cryptocurrency space. In this detailed exploration, we delve into the various aspects that influence ETH’s price and its position in the global market capitalization rankings.

Understanding Ethereum (ETH)

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of downtime, fraud, or third-party interference. It was created by Vitalik Buterin and launched in 2015. ETH is the native cryptocurrency of the Ethereum platform and is used to pay for transaction fees and services on the network.

Market Capitalization: What It Means

Market capitalization, often abbreviated as market cap, is the total value of all a cryptocurrency’s outstanding supply. It’s calculated by multiplying the current price of the cryptocurrency by its total supply. Market cap is a key metric for investors to gauge the size and potential of a cryptocurrency.

Ethereum’s Market Capitalization

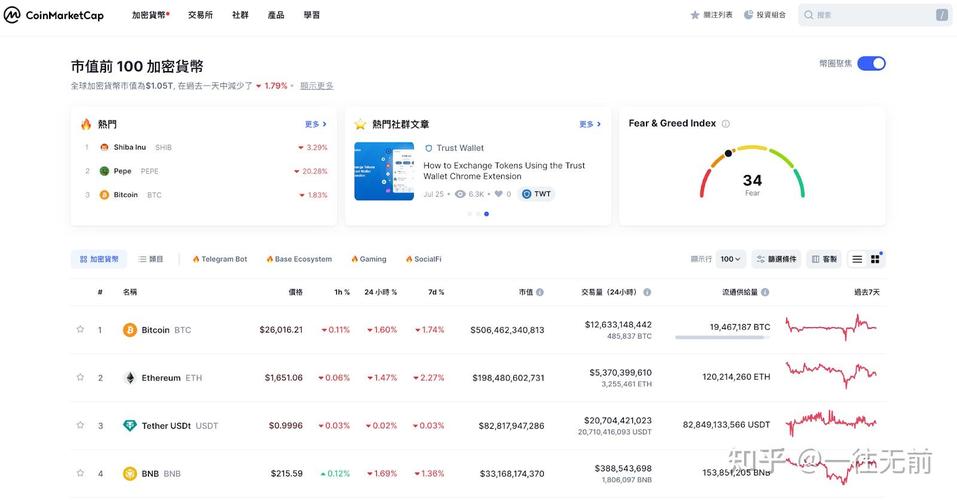

As of the latest data, Ethereum holds a significant position in the cryptocurrency market. Let’s take a look at its market capitalization in comparison to other major cryptocurrencies:

| Cryptocurrency | Market Capitalization (USD) |

|---|---|

| BTC (Bitcoin) | ~$500 billion |

| ETH (Ethereum) | ~$200 billion |

| USDT (Tether) | ~$70 billion |

| BNB (Binance Coin) | ~$50 billion |

| USDC (USD Coin) | ~$50 billion |

As you can see, Ethereum’s market capitalization is substantial, placing it second only to Bitcoin. This position is a testament to its widespread adoption and the trust investors have in the Ethereum platform.

Factors Influencing ETH Price

Several factors can influence the price of Ethereum. Here are some of the key drivers:

-

Supply and Demand: Like any other asset, the price of ETH is influenced by the basic economic principle of supply and demand. An increase in demand for ETH can lead to a rise in its price, while a decrease in demand can cause it to fall.

-

Network Activity: The level of activity on the Ethereum network, such as the number of transactions and smart contracts deployed, can impact its price. Higher activity often indicates greater demand for the network and its native currency.

-

Regulatory Environment: The regulatory landscape in different countries can significantly affect the price of ETH. Positive regulatory news can boost investor confidence, while negative news can lead to a sell-off.

-

Technological Developments: Ethereum’s ongoing development, including upgrades like Ethereum 2.0, can influence its price. These upgrades aim to improve the network’s scalability, security, and efficiency, which can attract more users and investors.

-

Market Sentiment: The overall sentiment in the cryptocurrency market can have a significant impact on ETH’s price. Factors such as market trends, news, and rumors can sway investor confidence and lead to price volatility.

Ethereum Price Prediction

Predicting the future price of Ethereum is challenging due to its inherent volatility. However, some experts and analysts provide predictions based on various factors. Here are a few predictions for the next few years:

-

Optimistic Outlook: Some analysts predict that Ethereum’s price could reach $10,000 by 2025, driven by its growing adoption and technological advancements.

-

Pessimistic Outlook: Others believe that Ethereum’s price could face challenges due to regulatory concerns and competition from other blockchain platforms. They predict a more modest price increase, potentially reaching $5,000 by 2025.

It’s important to note that these predictions