Are you considering investing in cryptocurrency but unsure where to start? Look no further! In this article, we delve into the fascinating world of Ethereum and explore the potential of investing with just 0.75 ETH. Get ready to uncover the ins and outs of this digital asset and discover how it can shape your financial future.

Understanding Ethereum

Ethereum, often abbreviated as ETH, is a decentralized blockchain platform that enables the creation of smart contracts and decentralized applications (DApps). Unlike Bitcoin, which is primarily used as a digital currency, Ethereum focuses on building a platform for developers to build and deploy decentralized applications.

One of the key features of Ethereum is its native cryptocurrency, ETH. ETH is used to pay for transaction fees on the Ethereum network and can also be used to purchase goods and services from merchants who accept it.

Investing with 0.75 ETH

Investing in Ethereum with just 0.75 ETH may seem like a small amount, but it can still offer significant opportunities. Let’s explore some of the ways you can make the most out of your investment.

1. Diversifying Your Portfolio

One of the most common strategies for investing in cryptocurrency is diversification. By allocating a portion of your investment to Ethereum, you can spread your risk across multiple assets. This approach can help mitigate potential losses in case one of your investments performs poorly.

2. Staking

Ethereum’s upcoming upgrade to Ethereum 2.0 will introduce a new feature called staking. Staking allows you to earn rewards by locking up your ETH in the network. With just 0.75 ETH, you can still participate in staking and potentially earn additional ETH over time.

3. DApps and Smart Contracts

Ethereum’s platform has enabled the development of numerous DApps and smart contracts. By investing in Ethereum, you indirectly support these innovative projects. Some DApps have already gained significant traction and have the potential to offer substantial returns on investment.

Understanding the Risks

While investing in Ethereum with 0.75 ETH can be exciting, it’s crucial to understand the risks involved. Here are some factors to consider:

1. Market Volatility

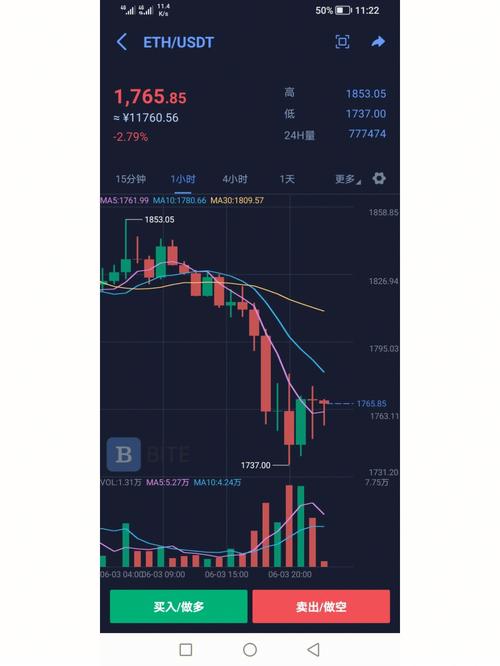

Cryptocurrencies are known for their high volatility. The value of Ethereum can fluctuate significantly in a short period, which means your investment could increase or decrease rapidly.

2. Regulatory Risks

The regulatory landscape for cryptocurrencies is still evolving. Changes in regulations can impact the value of Ethereum and its adoption as a digital asset.

3. Security Risks

Conclusion

Investing in Ethereum with just 0.75 ETH can be a rewarding experience if done with proper research and understanding of the risks involved. By diversifying your portfolio, participating in staking, and supporting innovative DApps, you can maximize your potential returns. However, always remember to stay informed about the market and take appropriate precautions to protect your investment.

| Investment Strategy | Expected Returns | Risks Involved |

|---|---|---|

| Diversification | Medium to High | Market volatility, regulatory changes |

| Staking | Medium to High | Network congestion, potential loss of funds |

| Supporting DApps | High | Market volatility, regulatory changes |